Understanding the impact of the 8% NDIS commitment – where will providers feel the pinch?

May 15, 2023

Where the 8% commitment will hit NDIS providers

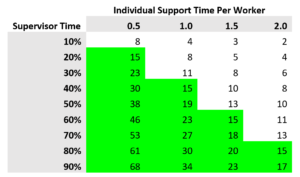

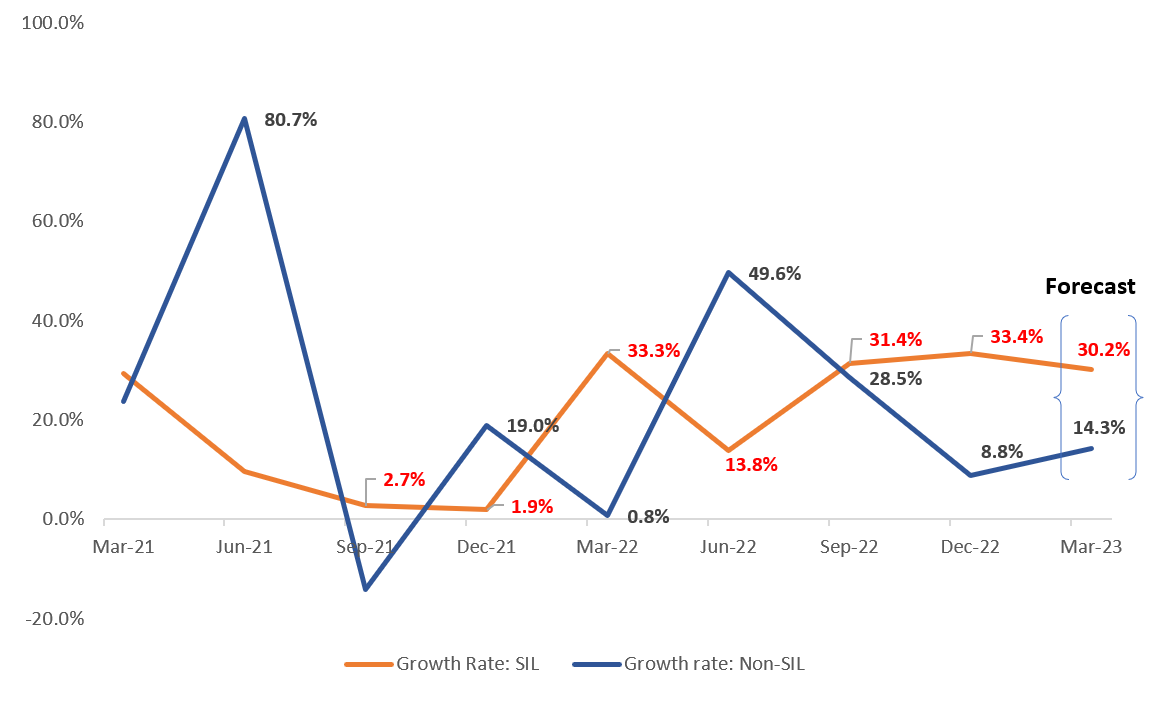

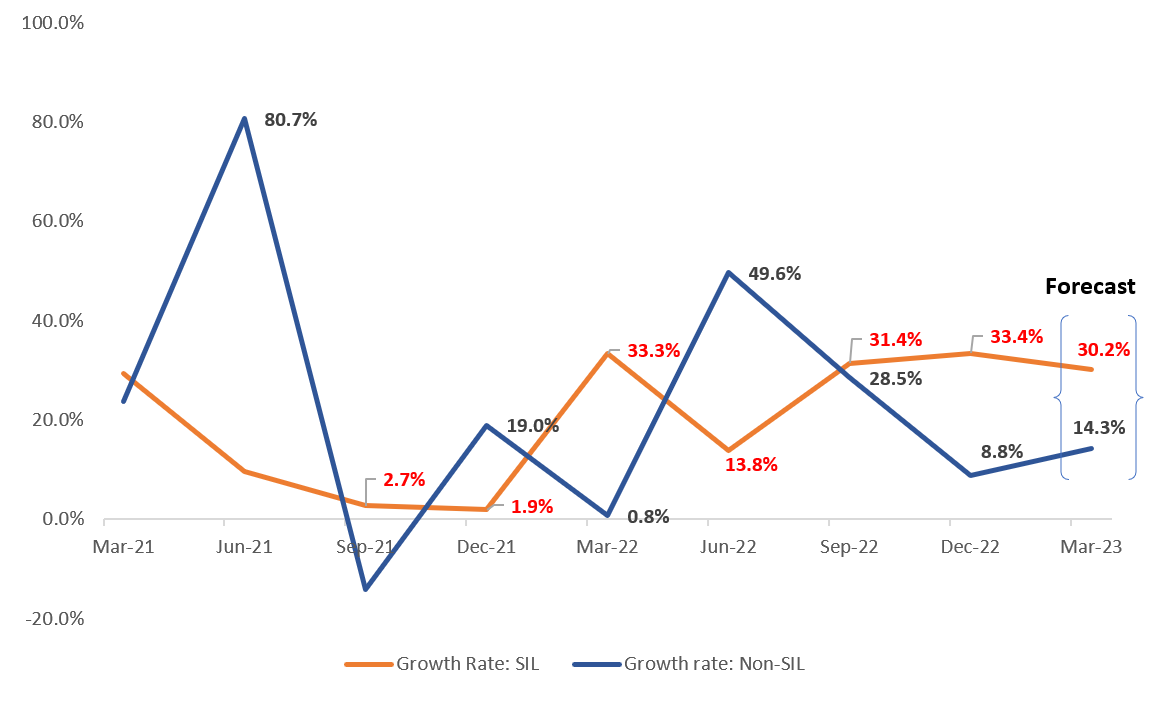

Recently we heard about the national cabinets decision to reduce the cost increase of the NDIS from 14% to 8% by 2026. Curiously, last quarter non-SIL costs grew by 8.8% (annualised) – what about SIL?

Figure 1: Quarterly growth rates annualised.

Now you can see what the fuss is about. In last quarter, growth in excess of 8.8% in total scheme spending was driven by SIL. Those of you still reeling from the 2021 SIL growth halt may find this “excess” difficult to compute, but there has been a recent boom in SIL spending, and in last quarter this reached 33.4% annualised, which was a single quarter increase of $211 million.

It is important to note that the NDIS received a new minister in June 2022, but the quarterly growth had already exploded in December 2021. Coincidentally (or not) this coincides with NSW’s 90% vaccination rate and the lifting of most public health restrictions, which may have released a wave of suppressed need.

Another look

However, reconstructing the same quarterly reporting form iterations of the quarterly report and data model generates a slightly different story:

Utilising this data set, we see a clear spike in growth in the September quarter, just as we hear that AAT cases are being promptly resolved and hospital discharge rates are improving. While it is difficult to determine the exact nexus of this trend reversal, it is clear that things are going to change.

How is SIL doing this?

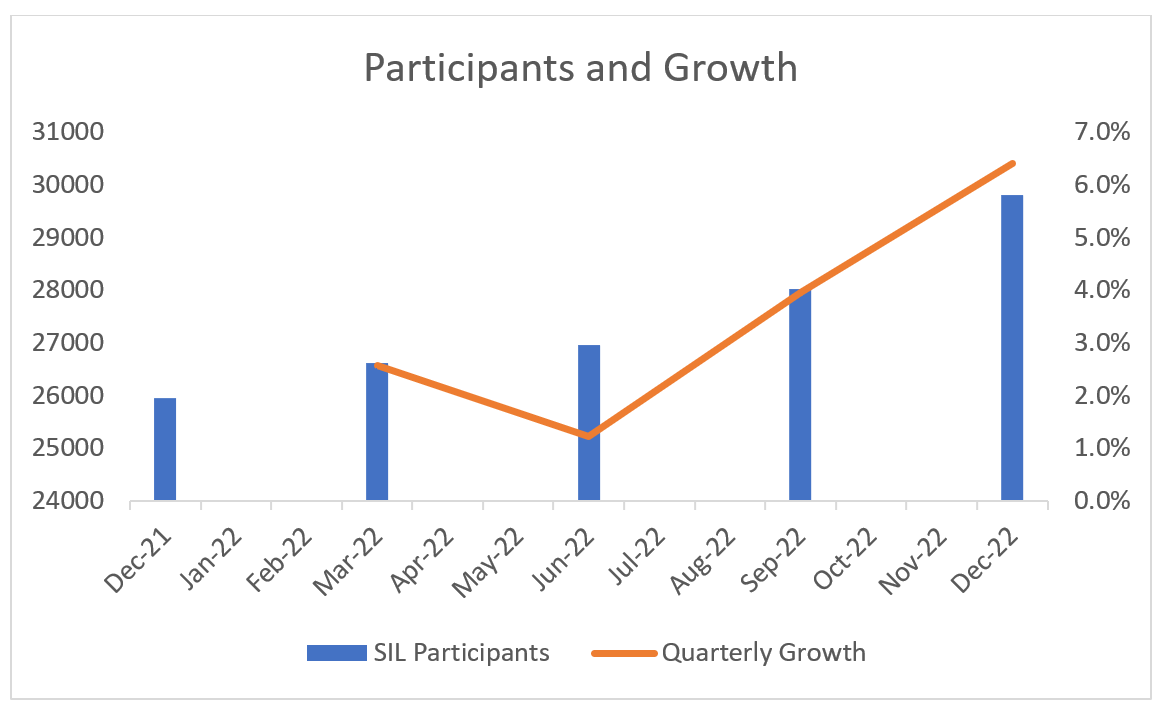

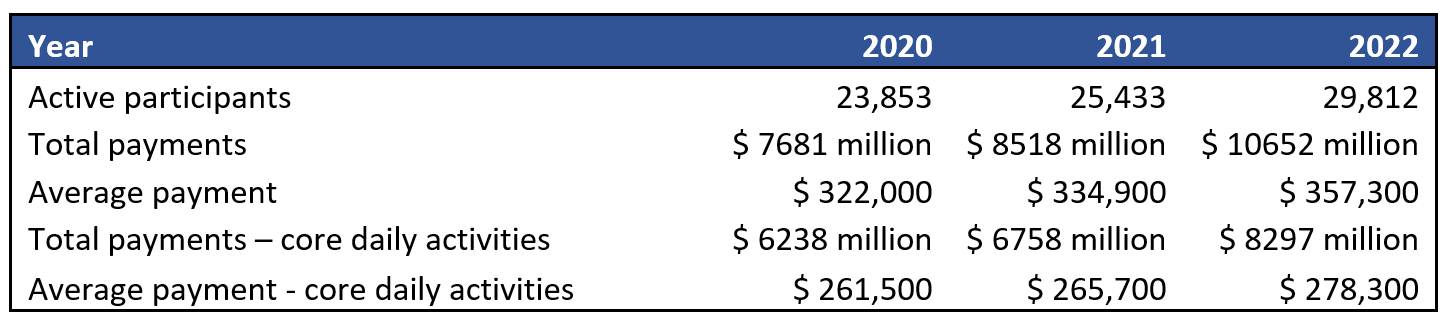

Many reading this will be worrying “is the NDIA going to prevent new entrants or cap plans?” and the answer is likely both, but mostly preventing new entrants. Here is how SIL has behaved in the last three years:

What is shocking, and likely worrying to the agency was the growth between 2021 and 2022, which was not anticipated by the productivity commission or recent re-forecasting.

Undoubtedly, most of cost increase comes from new customers. In 2021-2022, 28% of the SIL total spend increase was a result of plan increases, while 72% was the result of new SIL participants. In fact, when if we look solely at plan increase, SIL spending increases only by 6.7%, leaving very little room in an 8% target for new SIL customers. Interesting, the average SIL price increase was less than the total scheme price indexation of 6.9% for the year.

What would Q3 look like with an 8% cap?

If plans were indexed at 6.9%, things would quickly deteriorate in SIL markets. Based on current annual growth rates, in 2023 SIL would have just under 35,000 participants, reflecting growth of 5113 participants. An 8% cap would limit this growth to just 306 participants, causing a gap of 4826 based on expected projections.

As we can see from our table, SIL has significantly grown year on year, with a brief slowdown in 2021. And yet, despite us being across hundreds of SIL placements in our careers, we see very few SIL placement where supports weren’t reasonable and necessary.

This begs a crucial question: How can a growth cap be imposed on an uncapped scheme predicated on reasonable and necessary supports? Of course, we acknowledge that the minister has a serious issue on his hands with scheme sustainability that we demonstrated he didn’t start, but we also need to be clear on the metrics which cause a person “otherwise” suitable for SIL to miss out.

We’re starting to hear of cases where “SIL won’t be considered until mainstream supports fail” and this seems antithetical to the notion of intervening early to prevent unnecessary harm and enabling people to develop their independence. Naturally, we’re concerned that if just 6% of those expecting SIL receive it, mainstream supports will collapse, even if they were up to the task to begin with.

Naturally, this is a 2026 commitment, but considering what an 8% would look like tomorrow enables to understand the enormity of the undertaking, as well as anticipating which markets are likely to feel the most pressure in the future. We’re also morbidly curious about how it is possible in the first instance for growth rates to be so incredibly variable in a scheme that deals with people in need. We’ve two options to consider: the presentation rates and population dynamics vary tremendously or there are rationing mechanics at play that have be turned on and off again.

It’s an impossible job.

Getting growth under control with a scheme designed in this fashion is going to have consequences for people. Continued growth at the current rates will also have substantial consequences. It appears unlikely that a middle of the road approach will win favour in either camp. We certainly don’t envy the NDIA in this task, but we do worry about future SIL applicants and their families seeking much needed supports.

What can providers do?

Providers who are expecting to grow out of SIL sustainability issues need to quickly reconsider their plans. While SIL sustainability is driven largely by vacancies, rostering, overhead and supervisory spans of control play are crucial in achieving a sustainable operating position. We would encourage of readers to develop an understanding of their underlying site unit economics and develop action plans to resolve their sustainability issues without dependence on expected future growth. It appears that this strategy is nearing the end.

The SIL market is highly competitive with around 3000 active providers in the market. It is important to consider how your offer will stand up to just 300 customers seeking support in the market in any given year. While competition is tight at 5000 new entrants, consider the implications of 100 providers competing for individual customers. In the event of home and living coordinators entering the agency, it is more important than ever to be clear on your unique value proposition, and develop compelling value for your identified SIL segment.

If you’d like to discuss how your organisation can overcome these challenges, reach out to our team.

Share this article:

Continue reading Empathia Insights

QSC’s Own Motion part 2: how staff quality and practice leadership impact resident safety

As part 2 of the series, this article delves into the drivers of staff-generated abuse, evaluates the chances of implementing...