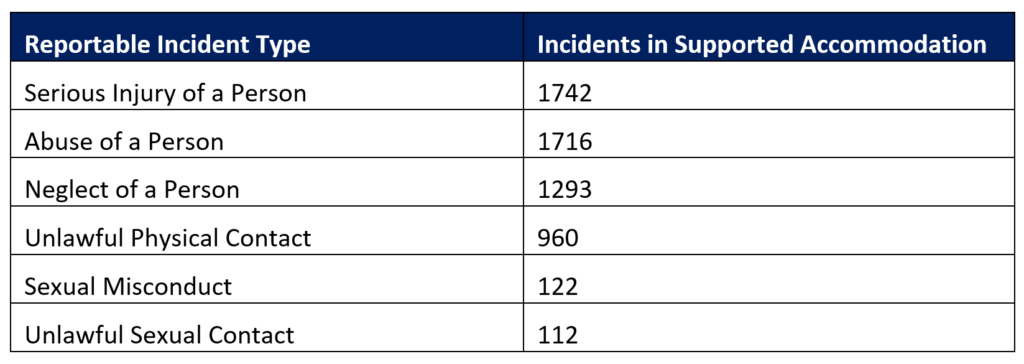

QSC’s Own Motion part 1: how safe is Supported Independent Living?

Examining 6,269 reportable incidents across 7 major providers and 1075 SIL sites, the study represents a significant portion of the SIL cohort, as the selected providers account for 18% of the total. The report suggests that although it is unlikely to lead to the “abolishment” of group homes, there are serious issues that must be addressed.

It’s not easy being a big SIL provider

It’s been a tough year for major providers. Unfortunately, they’re on the wrong end of a confluence of impacts. This means that transformation efforts are complicated because, in most cases, nearly all business functions are impacted by the NDIS cost model.

Is it getting harder to fill SIL vacancies?

We keep hearing across the sector that filling Supported Independent Living (SIL) vacancies is becoming increasingly more difficult for providers. As always, we reviewed the NDIS data to validate this assumption, and this is what we found.

A closer look at SIL profitability in 2022

Supported Independent Living (SIL) profitability varies significantly between providers. While many in the NDIS assume that most providers converge on margins of only 2% given the cost model, our data tells us the average margin SIL margin was 4.5%, with considerable variance (3.15% SD).

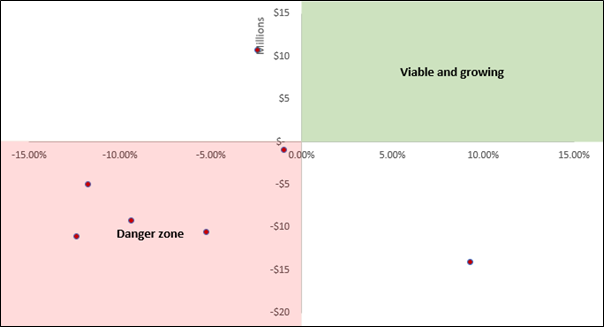

The big SIL providers are still struggling

This quarter, we consolidated the 2022 Supported Independent Living (SIL) data to review the performance of the biggest providers, and most are still struggling.

The big issue with funding

This chart shows the average cost per decile in funding for 2020-2021. What is fascinating about this chart is that it is controlled for SIL status, age, disability type and presentation intensity. Essentially, this chart isolates the variation that is produced by individual circumstances, interpretations of “reasonable and necessary”, and intra-planner variation. In a nutshell, this chart shows that plans vary wildly even when controlling for intensity, disability type, age and SIL Status.

Did the largest SIL providers underperform the market?

The largest SIL providers have a considerable impact on the sector. This is because most people in the sector have been exposed to their branding, and it is assumed their products are refined and well received. However, a new data set from the NDIS reveals that the largest SIL providers have considerably underperformed the rest of the SIL market. Below are the growth rates for Core – Daily Activities funding for SIL participants only:

How did the biggest Supported Independent Living providers perform in 2020-21?

It’s that time of year when Empathia Group combs through annual reports to pull out performance insights, and what a year it was! This year we have access to the ten largest providers by SIL payments (agency managed).

Where do new SIL customers come from?

Does this table suggest that in 2021-2022 Q1, only an additional 11 participants had SIL in their plans? You’re likely thinking the same thing I did – how is this possible? And our readers would know that it isn’t – we have previously reported that 327 customers entered SIL in the same period (and that was also from the NDIA).

Is the Supported Independent Living market flatlining?

The SIL market is reaching an inflection point that will change market dynamics. Our last article demonstrated that new customer growth is slowing in the SIL market. This article is number two in our SIL market series, and we will evaluate the total size of the SIL market and the implications for providers.