It’s not easy being a big SIL provider

It’s been a tough year for major providers. Unfortunately, they’re on the wrong end of a confluence of impacts. This means that transformation efforts are complicated because, in most cases, nearly all business functions are impacted by the NDIS cost model.

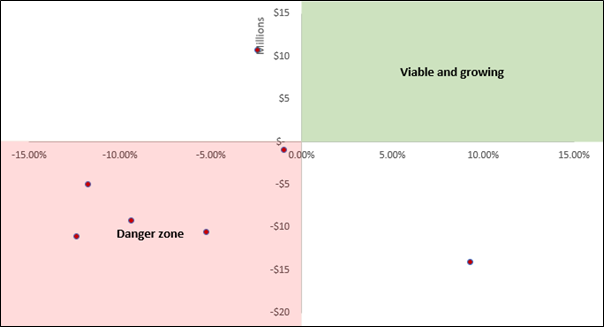

Board members of NDIS providers need to see these 2022 results

Three NDIS providers reported a combined loss of $15 million, with only one posting a minuscule 0.78% margin. These results are a far cry from the exorbitant profits we’ve seen in the media recently.

Is it getting harder to fill SIL vacancies?

We keep hearing across the sector that filling Supported Independent Living (SIL) vacancies is becoming increasingly more difficult for providers. As always, we reviewed the NDIS data to validate this assumption, and this is what we found.

Why NDIS product strategy is almost always wrong

Let’s say your SIL business is entering the Sydney market for the first time. You will need certain inclusions, such as a robust incident management process. This process is a high-weight critical system required to perform the service. However, it is also low-variance because it varries little between competitors. Therefore, it can not serve as a point of difference. We call these inclusions table stakes.

A closer look at SIL profitability in 2022

Supported Independent Living (SIL) profitability varies significantly between providers. While many in the NDIS assume that most providers converge on margins of only 2% given the cost model, our data tells us the average margin SIL margin was 4.5%, with considerable variance (3.15% SD).

Did the largest SIL providers underperform the market?

The largest SIL providers have a considerable impact on the sector. This is because most people in the sector have been exposed to their branding, and it is assumed their products are refined and well received. However, a new data set from the NDIS reveals that the largest SIL providers have considerably underperformed the rest of the SIL market. Below are the growth rates for Core – Daily Activities funding for SIL participants only:

How did the biggest Supported Independent Living providers perform in 2020-21?

It’s that time of year when Empathia Group combs through annual reports to pull out performance insights, and what a year it was! This year we have access to the ten largest providers by SIL payments (agency managed).

For profit providers are more likely to believe the price is right

National Disability Services releases a State of the Disability Sector Report each year, and it is quite a read. One interesting and potentially concerning finding in the report is that for-profit providers are far less likely to worry about providing NDIS services at the current pricing. This finding is curious and worth looking at. Indeed, the following worrying remarks selected by the NDS intimate that there is malcontent toward these providers:

Is the Supported Independent Living market flatlining?

The SIL market is reaching an inflection point that will change market dynamics. Our last article demonstrated that new customer growth is slowing in the SIL market. This article is number two in our SIL market series, and we will evaluate the total size of the SIL market and the implications for providers.

The one chart that explains the state of SIL

Let’s take some time to unpack this chart. We’re looking at the number of new participants entering SIL per quarter since June 2017. We’re currently at the red dot. Only 327 additional participants had SIL entered into their plan in the last quarter. Consider that the average in 2020 was 610, and the average in 2019 was 1349. Does 327 still sound like a lot of participants to you who might be interested in your service?