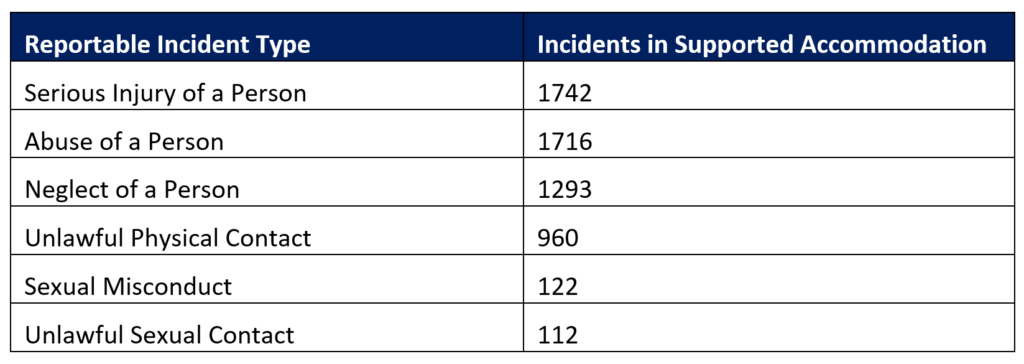

QSC’s Own Motion part 1: how safe is Supported Independent Living?

Examining 6,269 reportable incidents across 7 major providers and 1075 SIL sites, the study represents a significant portion of the SIL cohort, as the selected providers account for 18% of the total. The report suggests that although it is unlikely to lead to the “abolishment” of group homes, there are serious issues that must be addressed.

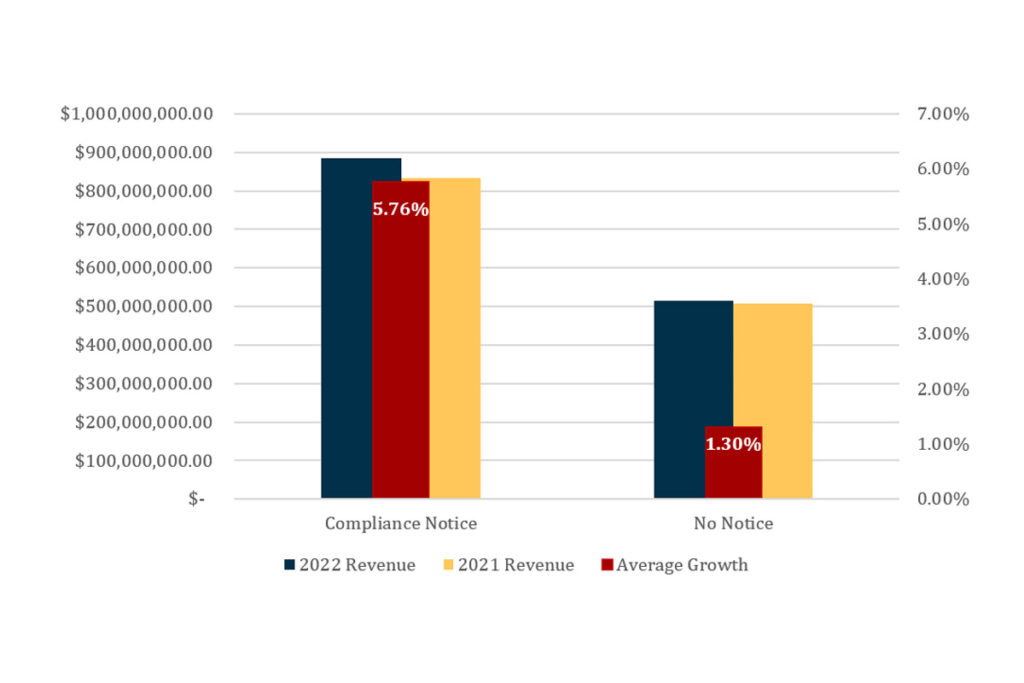

How can a QSC compliance notice lead to growth?

n most markets, we expect government enforcement actions to present serious risks and challenges to businesses. But, unsurprisingly and concerningly, this does not appear to be the case in the NDIS.

Board members of NDIS providers need to see these 2022 results

Three NDIS providers reported a combined loss of $15 million, with only one posting a minuscule 0.78% margin. These results are a far cry from the exorbitant profits we’ve seen in the media recently.

Support worker employment trends reaching critical levels

The support worker employment market is at critically constrained levels, just as we approach seasonal increases in turnover, leave requests, and another potential COVID-19 outbreak. In this article, we reviewed the latest data to find some support worker recruitment solutions.

Our take on disability employment data and theField.jobs

Disability employment has re-entered the spotlight recently with an enquiry into Disability Employment Services (DES) as part of the Disability Royal Commission, along with the launch of a promising new disability-focused jobs website, the Field, co-founded by Dylan Alcott and funded by the Department of Social Services.

Is it getting harder to fill SIL vacancies?

We keep hearing across the sector that filling Supported Independent Living (SIL) vacancies is becoming increasingly more difficult for providers. As always, we reviewed the NDIS data to validate this assumption, and this is what we found.

Why NDIS product strategy is almost always wrong

Let’s say your SIL business is entering the Sydney market for the first time. You will need certain inclusions, such as a robust incident management process. This process is a high-weight critical system required to perform the service. However, it is also low-variance because it varries little between competitors. Therefore, it can not serve as a point of difference. We call these inclusions table stakes.

A closer look at SIL profitability in 2022

Supported Independent Living (SIL) profitability varies significantly between providers. While many in the NDIS assume that most providers converge on margins of only 2% given the cost model, our data tells us the average margin SIL margin was 4.5%, with considerable variance (3.15% SD).

Does your NDIS business have an EVP, and does it make a difference?

We recently reviewed ten Seek ads for frontline support workers and observed little evidence of real employee value propositions (EVP). While we saw some variance in pay rates, we know that providers’ hands are somewhat tied by the Disability Support Worker Cost Model (DSWCM).

The big SIL providers are still struggling

This quarter, we consolidated the 2022 Supported Independent Living (SIL) data to review the performance of the biggest providers, and most are still struggling.