It’s not easy being a big SIL provider

It’s been a tough year for major providers. Unfortunately, they’re on the wrong end of a confluence of impacts. This means that transformation efforts are complicated because, in most cases, nearly all business functions are impacted by the NDIS cost model.

The big SIL providers are still struggling

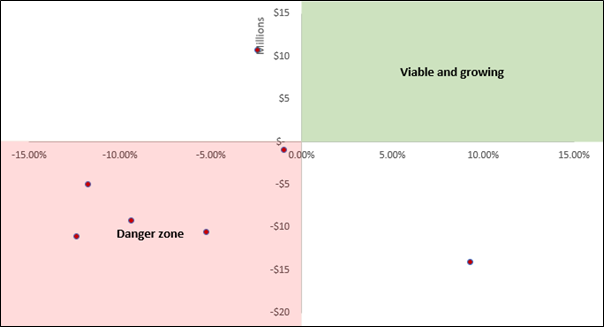

This quarter, we consolidated the 2022 Supported Independent Living (SIL) data to review the performance of the biggest providers, and most are still struggling.

Did the largest SIL providers underperform the market?

The largest SIL providers have a considerable impact on the sector. This is because most people in the sector have been exposed to their branding, and it is assumed their products are refined and well received. However, a new data set from the NDIS reveals that the largest SIL providers have considerably underperformed the rest of the SIL market. Below are the growth rates for Core – Daily Activities funding for SIL participants only:

How did the biggest Supported Independent Living providers perform in 2020-21?

It’s that time of year when Empathia Group combs through annual reports to pull out performance insights, and what a year it was! This year we have access to the ten largest providers by SIL payments (agency managed).

Which providers did well in the NDIS in 2019/2020?

It surprises me that it has taken this long for someone to compare the performance of some of Australia’s largest NDIS providers. There is so much to learn from the different approaches to growth, sustainability and service. We went ahead and put it together (note: we extracted or extrapolated NDIS revenue only):