- Want to get in touch?

November 29, 2022

During our travels across the sector, we keep hearing how support worker recruitment difficulties are impacting growth and service quality. We’ve crunched the numbers, and it’s worse than we imagined.

The support worker employment market is at critically constrained levels, just as we approach seasonal increases in turnover, leave requests, and another potential COVID-19 outbreak. In this article, we reviewed the latest data to find some support worker recruitment solutions.

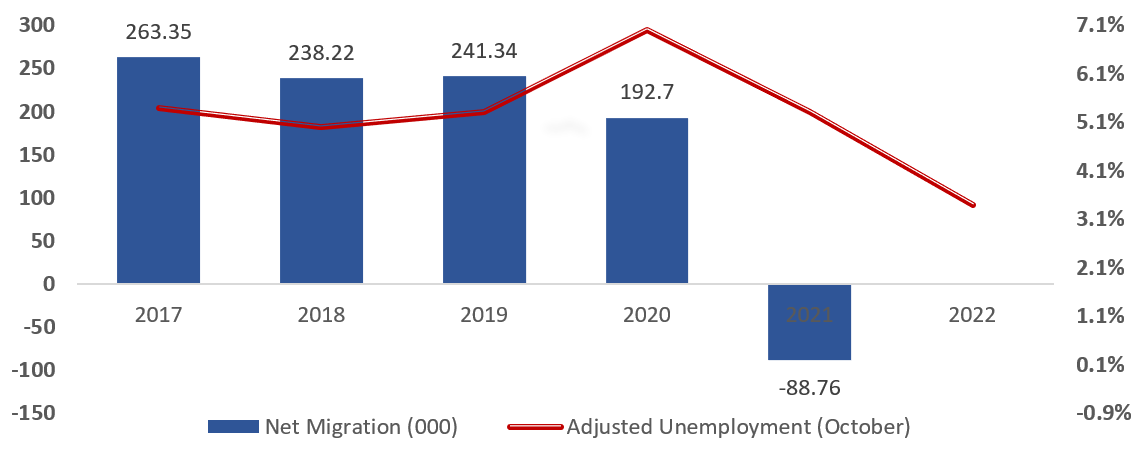

Unemployment rate Vs. net immigration

Source: ABS

COVID-19 has thrown a spanner in the works in the national unemployment rate. Unemployment in Australia is at historic lows, largely precipitated by an enormous reduction in migration generated during the COVID-19 pandemic. Unfortunately, It is likely we’ll see a slow recovery in this area as the impact of Australian housing prices and cost of living deter potential migrants.

We expect that it will take a few more years before the immigration rate stabilises historic unemployment. As a result, this makes hiring and retaining workers extremely difficult in almost any industry. This issue is compounded by inelastic wage pressures in the face of serious consumer good inflation.

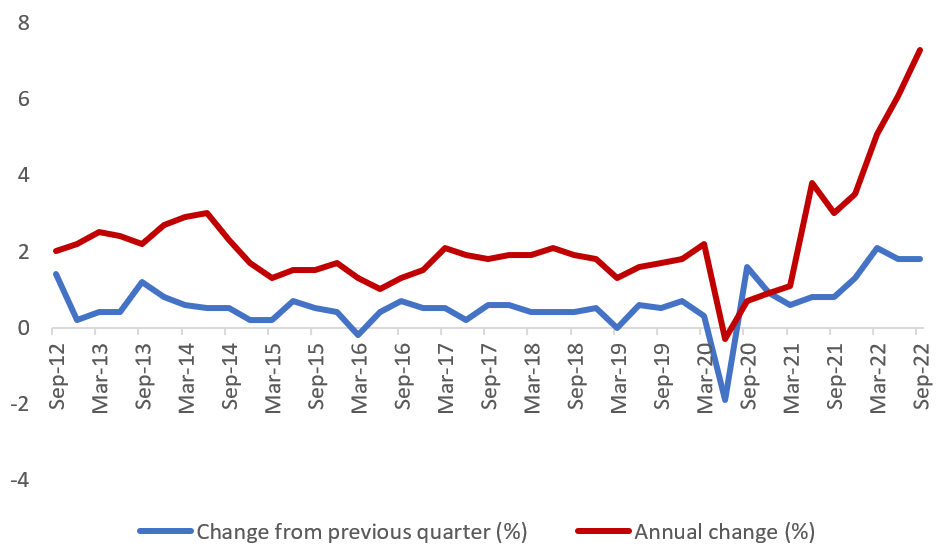

Inflation rate

Source: ABS

The struggle to find good workers is not in our imagination. Tight job markets, in addition to strong inflationary pressure, create the conditions for support workers to seek new roles in the pursuit of an inflation-resistant income. These three forces are enough to constrain any labour market. However, in our context, it is much worse.

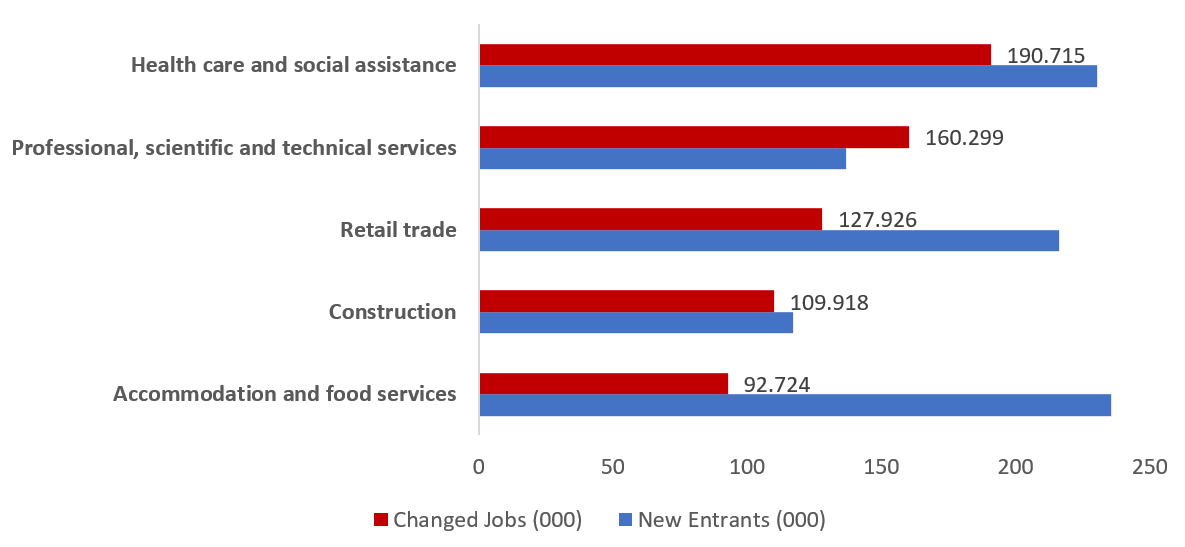

The social support industry experiences the largest movement of staff in and out of jobs in the Australian economy. While many of us have “felt” this phenomenon, ABS has the data to demonstrate it clearly.

Below are the 2022 job mobility figures, which indicate how many people in each sector are entering the market or changing jobs.

2022 Job mobility

Source: ABS

Our industry has the highest job mobility rate in the entire sector and, unsurprisingly, Empathia Group’s benchmarking data indicates an average turnover rate of 35%. We believe these mobility metrics are likely to worsen as inflationary pressures push more support workers into higher paying industries, facilitated by historic low unemployment. While this turnover is serious, attempting to recruit replacements in these economic conditions will be exceptionally difficult.

Many industries experience seasonally heightened turnover in the Christmas period. This is driven by several factors, including leave request refusal, graduation, and the psychological significance of a “new year”. Considering this, we expect that much of the NDIS market will find it exceptionally difficult to replace staff exiting during this heightened turnover period.

In addition, the Christmas period is one of increased labour demands influenced by leave provisions and the temporary shutdown of many day services necessitates additional Supported Independent Living (SIL) supports and community access labour requirements. And finally, the Department of Health is seeing an increase in COVID-19 case numbers in Australia, reflecting community transmission of the new Omicron variant XBB, increasing sick leave beyond its usual measures.

These forces, coupled with nuances of our industry will result in one of the most challenging Christmas and post new year labour markets we have seen in the NDIS. We’re not joking; we’re seriously urging our customers and the broader NDIS market to take in their labour force now before critical staff shortages emerge.

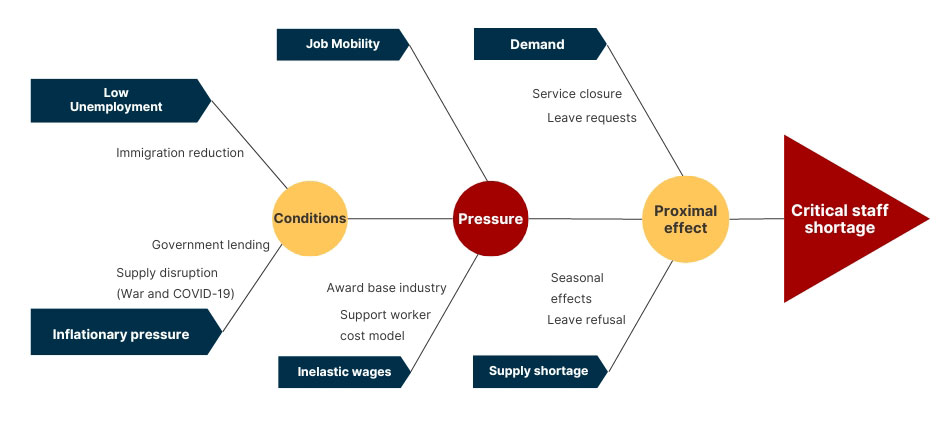

To assist our partners with communicating this risk to their boards, we’ve summarised the driving forces and expected outcomes in a fishbone diagram.

Get ready now

Shortages of crucial staff have serious impacts across the business. In the short term, staff shortages can create further significant turnover problems, as staff become increasingly burnt out and required to work with clients outside of their comfort zone. This effect “climbs” through organisations as leaders are increasingly required to perform shifts on the frontline to keep customers safe.

We’re seeing overtime rates increase across the sector, and even small increases in overtime rates can be extremely damaging to margins and an organisation’s viability. Unfortunately, as essential workers, organisations have little option but to commit to overtime to keep their customers safe and engaged.

Staff shortages also critically impact growth opportunities for organisations. The average SIL placement requires 6.5 staff to fill, and often customers need placements urgently. It has become apparent that the organisations successfully growing in SIL will be those who have figured out how to be an employer of choice.

Finally, and most importantly, staff shortages limit the choice and control of our customers. A core principle of the NDIS is that providers should give customers a choice of who supports them. Organisations pushing a 10% overtime rate are now able to afford this choice to customers or staff.

Now is the most critical time to get your employee attraction, selection, and retention strategies on point. At this time in the game, it is no longer sufficient to have them to a “standard” you will genuinely need to stand out as an employer of choice to compete in this market.

In terms of attraction, robust processes to ensure a rapid time to hire and smooth candidate experiences are essential. It is common to see defection rates during the “contract offer” phase as applicants accept roles in organisations that are faster to offer and select.

Secondly, reducing turnover in your organisation is paramount; your employees are essential to the quality of customer outcomes and will be exceedingly difficult to replace. Utilising an engagement survey that adequately measures core determinants of support worker turnover is more critical than ever. Using this data, getting your pay structure, promotional opportunities, and an appropriate development schedule will assist in keeping good people.

Finally, the leadership quality, especially in SIL, is a major determinant of turnover and customer outcomes. Frontline leadership and practice leadership are significant mediators of how safe staff feel in a placement, how fairly they believe they are being treated, and the outcomes being achieved by clients. In terms of NDIS product strategy don’t forget, front-line leadership is a high variance and high weight strategy feature that can be pathway to real differentiation.

If you are interested in discussing your workforce strategy and how to position your business differently in the support worker job market, book a call or reach out to our team.

Share this article:

Join an exclusive community of providers receiving our eNewsletter Empathia Insider. Get first access to NDIS business insights, free provider resources, and special offers direct to your inbox.

Empathia Group is a collective of business consultants focused on creating sustainable, long-term success for NDIS service providers.

Appointments outside of standard business hours available by request

Empathia Group Pty Ltd © 2022. All rights reserved.