It’s not easy being a big SIL provider

January 11, 2023

This article reviews the growth and financial performance of the top 7 Supported Independent Living (SIL) providers nationally.

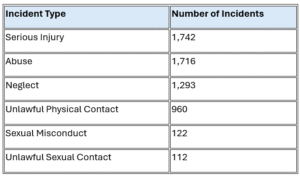

Straight into the data, the chart below shows financial performance against adjusted NDIS SIL growth (adjusted growth reflects the changes in average package size).

Growth vs. financial performance by provider

What immediately stands out is that this was a disastrous year for most of the top providers. Other than Scope, not one other organisation we reviewed achieved both viability and growth in 2022. Despite this, the SIL market grew by 9% on a per-participant basis.

On average, this group made a $5.5 million loss, despite substantial COVID-19 subsidies offered by the NDIS. When adjusted for package size, the average growth was -4.1%, with only one major provider reporting significant growth for the period.

NDIS fraud may still be a real concern and hot topic in the media, but it’s unlikely what’s happening here. According to the data, their financial performance and wage expenses suggest revenue is indeed being expended on services. Instead, it seems that much of these losses are linked to SIL vacancies, roster inefficiencies, plan changes, and overhead structures.

Transformation, again.

Many larger providers have undergone significant transformations in the last few years to come to terms with new margins in the NDIS. Throughout our work, we’ve identified the factors that lead to sustained, successful transformation efforts.

They understand their baseline first

While margins can be difficult for the largest providers, those who have succeeded in transforming typically understand how they stuck up against the NDIS cost model and provider benchmarks. Understanding their position enables them to do a comprehensive gap analysis against their wage, overhead and supervisory performance. When armed with this information, providers usually undertake just one transformation rather than missing the mark.

They undertake processes analysis based on their gaps

Organisations that complete a robust requirements and process analysis are far better equipped to make and sell the changes necessary to compete in the NDIS viably and effectively. While this often spells some initial discomfort, they can understand which processes they need to adjust to their system and which processes can remain within their business. We’re sure many of our readers will have been at the other end of system implementation, only to be told that key requirements “are in development”.

They’re honest about their overhead

Major organisations typically have legacy functions from state government funding days. These teams are usually comprised of great people who understand the sector and want to make a difference. However, much of what was in the block funding days does not comport with the cost model.

Organisations that take an honest look at their overhead requirements and develop structured service level agreements between back-office teams and their operations ensure that they receive great value and that everyone is clear on the expected service level. Without Service Level Agreements (SLAs) in place, it is almost impossible for organisations to receive the type of support that enables them to be effective and viable.

They always know the exact state of their vacancies

Unsurprisingly, vacancy management is a major determinant of viability. Organisations that build dashboards that clearly match their lead pipeline to expected vacancies are in a far better position to understand their vacancy impact from top to bottom. These organisations also adjust their profit and loss for vacancy impacts, so they know if an individual SIL home is performing where a vacancy has destroyed the usefulness of the P&L.

Wrapping up

It has been a tough year for major providers; unfortunately, they’re on the wrong end of a confluence of impacts. This means that transformation efforts are complicated because, in most cases, nearly all business functions are impacted by the NDIS cost model.

If you would like to talk about a transformation activity, or have other questions about the NDIS, reach out to our team or book a call.

Share this article:

Continue reading Empathia Insights

Kafkaesque: The Moral Hazard at the Heart of SIL

Kafkaesque: The Moral Hazard at the Heart of SIL Dean Bowman November 18, 2025 Supported Independent Living The Federal Court's...