The Top 10 NDIS Providers in 2024: Difficulty at scale and lessons for the sector

There’s a persistent rumour in the disability sector that the National Disability Insurance Agency (NDIA) is slowly corralling services into just a handful of mega-providers. But does that theory hold water? Our look at the top 10 attendant care non-profits suggests it might not. Despite commanding over billions in combined revenue, these organisations still occupy a surprisingly small slice of total NDIS payments and the same difficult operating environment, albeit at substantial scale.

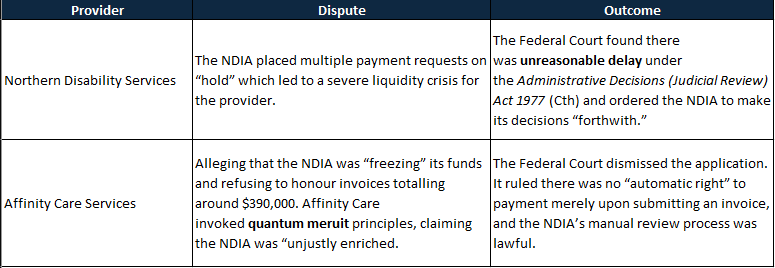

Recent Federal Court Rulings on NDIS Payment Reviews

Two recent Federal Court decisions have shed new light on how the National Disability Insurance Agency (NDIA) handles payment reviews for NDIS service providers. While no doubt many of you have heard of “periodic payment reviews”, these cases provide some crucial insight into how they function. If you operate in this space—especially on thin margins—understanding these rulings may be critical to protecting your organisation’s cashflow and ensuring regulatory compliance.

It’s not easy being a big SIL provider

It’s been a tough year for major providers. Unfortunately, they’re on the wrong end of a confluence of impacts. This means that transformation efforts are complicated because, in most cases, nearly all business functions are impacted by the NDIS cost model.

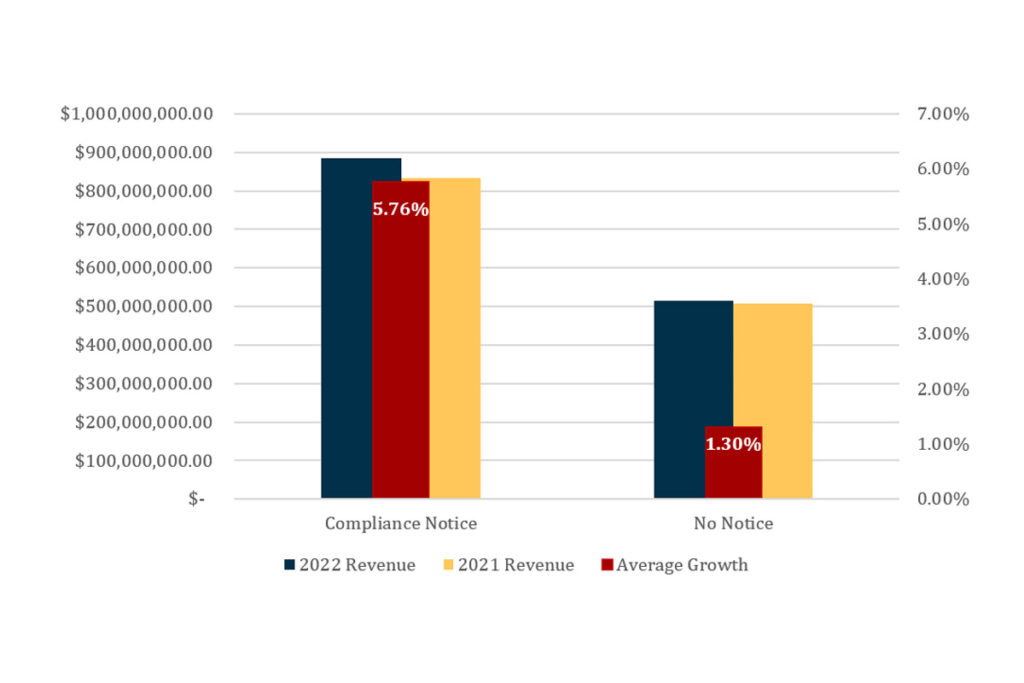

How can a QSC compliance notice lead to growth?

n most markets, we expect government enforcement actions to present serious risks and challenges to businesses. But, unsurprisingly and concerningly, this does not appear to be the case in the NDIS.

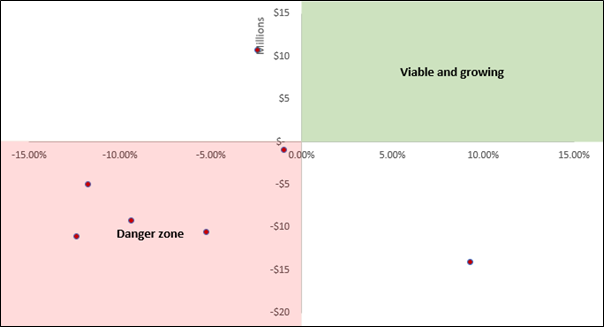

Board members of NDIS providers need to see these 2022 results

Three NDIS providers reported a combined loss of $15 million, with only one posting a minuscule 0.78% margin. These results are a far cry from the exorbitant profits we’ve seen in the media recently.

Support worker employment trends reaching critical levels

The support worker employment market is at critically constrained levels, just as we approach seasonal increases in turnover, leave requests, and another potential COVID-19 outbreak. In this article, we reviewed the latest data to find some support worker recruitment solutions.

Our take on disability employment data and theField.jobs

Disability employment has re-entered the spotlight recently with an enquiry into Disability Employment Services (DES) as part of the Disability Royal Commission, along with the launch of a promising new disability-focused jobs website, the Field, co-founded by Dylan Alcott and funded by the Department of Social Services.

Is it getting harder to fill SIL vacancies?

We keep hearing across the sector that filling Supported Independent Living (SIL) vacancies is becoming increasingly more difficult for providers. As always, we reviewed the NDIS data to validate this assumption, and this is what we found.

Why NDIS product strategy is almost always wrong

Let’s say your SIL business is entering the Sydney market for the first time. You will need certain inclusions, such as a robust incident management process. This process is a high-weight critical system required to perform the service. However, it is also low-variance because it varries little between competitors. Therefore, it can not serve as a point of difference. We call these inclusions table stakes.

De-platforming and decentralising to save the disability workforce

As with all attendant care matters in the NDIS, career progression is heavily constrained by the cost model.