- Want to get in touch?

Dean Bowman

December 3, 2025

As the disability sector continues advocating for SIL price increases, it’s worth examining the economic and political dynamics that shape pricing decisions. This analysis explores what policymakers likely observe in the data, the constraints they face, and why the path to price increases may be steeper than many anticipate.

National Cabinet established an 8% annual growth target for NDIS expenditure in June 2023, with government projecting $14.4 billion in savings over four years from July 2024. This creates a binding fiscal constraint that shapes all pricing discussions. Facing such constraints, policymakers cannot rely primarily on provider sentiment, however legitimate, to justify significant expenditure increases. While survey data showing 81% of providers concerned about pricing viability provides important context, it presents challenges as a decision-making foundation: sentiment is subjective, reflects aggregate concerns across diverse service lines, and doesn’t differentiate between calls for margin improvement versus genuine market failure.

Instead, governments facing fiscal constraints tend to rely on objective metrics that provide verifiable signals of market health. Three metrics stand out as particularly useful for pricing decisions:

These metrics offer something sentiment cannot: objective, quantifiable evidence of whether markets are clearing efficiently or experiencing dysfunction requiring intervention.

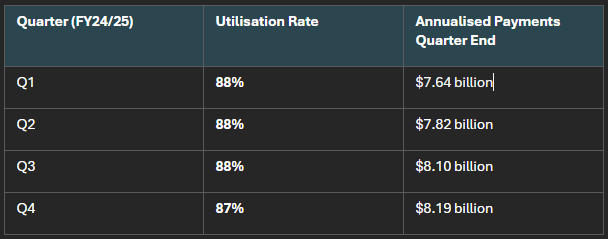

The current SIL utilisation data tells a specific story:

Quarter (FY24/25) | Utilisation Rate | Annualised Payments Quarter End |

Q1 | 88% | $7.64 billion |

Q2 | 88% | $7.82 billion |

Q3 | 88% | $8.10 billion |

Q4 | 87% | $8.19 billion |

Utilisation rates of 87-88% are remarkably high and stable. This consistency across four quarters suggests participants are accessing services, providers are delivering supports, and the market is clearing efficiently at current price levels.

From a policy perspective, 87-88% utilisation represents what efficient markets look like: not too low to signal dysfunction, not so high as to suggest inadequate funding, but in the zone where supply and demand meet effectively.

Compare this to therapy supports, which experienced price freezes for four consecutive years and had travel/access components reduced despite provider advocacy. Therapy supports had utilisation rates below 70%, before the recent pricing intervention. This example demonstrates that treasury likely understand utilisation is an important fiscal tool, and that markets with relatively poor utilisation are still subject to downward market intervention. This places SIL’s utilisation rate firmly outside of the band where one could expect pricing action.

The combination of high utilisation and rapid spending growth tells an important story about supply dynamics:

Year | Participants | Total Payments ($M) | Avg Payment |

2022 | 28,018 | $9,222 | $347,700 |

2023 | 32,973 | $12,254 | $397,900 |

2024 | 35,371 | $14,463 | $422,300 |

2025 | 36,641 | $15,896 | $438,200 |

Growth 2022-2025 | +31% | +72% | +26% |

When spending grows by 72% while utilisation remains constant at 87-88%, it reveals that budgeted/allocated funds are growing substantially (more participants, higher plan values) AND participants are successfully accessing services at the same high rate. This means supply is expanding in lockstep with demand. If budgets had grown but utilisation fell, that would signal supply failure, participants couldn’t spend their allocated funds because services weren’t available. But sustained high utilisation alongside spending growth demonstrates the market is successfully scaling capacity to meet expanding budgeted demand.

While survey data shows legitimate provider concerns about operating conditions, actual capital allocation tells a different story. From the NDS data In 2025:

This creates an interesting dynamic from a policy perspective. Providers are simultaneously:

From a government perspective facing fiscal constraints, this gap between stated sentiment and revealed preference through behaviour becomes relevant. Organisations making rational resource allocation decisions are choosing to expand SIL capacity. This suggests, whatever the challenges in other service lines or smaller providers’ experience, that major players see continuing viability in SIL at current pricing.

When providers allocate scarce capital to expand a service line while simultaneously advocating for price increases in that line, it signals the service remains economically viable even if margins aren’t what providers would prefer.

This isn’t to dismiss provider concerns, operating environments are genuinely challenging, and many organisations face real pressures. But it does suggest that there is a substantial segment of the market demonstrating preference falsification with the view of margin optimisation. It is important to note that the SIL market is notoriously quality opaque, and it is unlikely that quality supports will be able to exert a price signal soon. This does unfortunately mean that SIL will continue a rapid race to the bottom unless quality is effectively priced in. Given the lack of any such mechanism on the horizon, our view is that SIL will continue to behave like a commodity. Which leads to the next question:

One concern worth addressing: what if major providers exit? The SIL market exhibits remarkably low concentration, which provides inherent resilience:

Metric | Annual Amount |

Top 3 Providers Combined NDIS Revenue | $1,250 million |

Annual SIL Market Expansion | $2,200 million |

Market Expansion as % of Top 3 | 176% |

The annual SIL market expansion ($2.2 billion) is 176% of the top three providers’ combined NDIS revenue. This means that even in the extreme scenario where all three major providers simultaneously exited (which is extraordinarily unlikely) the market’s natural growth would absorb their capacity within approximately seven months.

Moreover, there have been provider exits from the NDIS more broadly, yet the utilisation data shows no disruption. The market absorbed these exits without visible impact on service delivery. This is demonstrated resilience that the NDIA are likely aware of. The sector has already stress-tested its ability to maintain function through provider churn, and the data shows it passed that test.

Gresham’s law stated as “Bad money will drive out good money” is a sort of structural race to the bottom that SIL is current subjected to. Presently, from an outside perspective (such as that of participants purchasing SIL for the first time) there are no reliably quality signals that differentiate one SIL product from another. This is exacerbated by the sheer volume of conflicted intermediaries in the sector (unfortunately, many unconflicted intermediaries have been driven out by price freezing).

In the peculiar case of SIL “bad money” can drive out good money with the following advantages.

With the lack of rigorous enforcement, or a visible service standard for SIL, Gresham’s law will play out to its logical conclusion. Noting that while utilization for SIL is high and funding is expanding, Gresham’s law will also likely prevent the improvement of pricing or SIL structuring. In fact, it may worsen it substantially, noting that any degree of freedom offered to the market may be abused for profit generation.

You can see this pattern for yourself by observing Freedom Care Group’s organic growth rate when contrasted against large incumbents who one would have thought, have significant structural advantages.

It’s worth acknowledging the unique political economy of SIL. Government understands that SIL participants typically require substantial 24/7 care with significant safety considerations. These support needs are documented in NDIA planning decisions and involve vulnerable individuals with complex requirements.

This creates an important constraint: any action that threatens SIL supply would be politically challenging regardless of the economic rationale. This is quite different from other support categories where service interruption, while undesirable, might be less immediately critical. This offers SIL some protection against the perverse incentive of the NDIA, to constrain utilisation to find automatic spending savings. The political constraint means SIL pricing likely sits in a particular equilibrium, it cannot be reduced without risking supply to vulnerable participants, but the market signals don’t create pressure for increases either.

Finally, it’s worth considering the fiscal implications of price increases. Current SIL payments are approximately $8.2 billion:

Against a $14.4 billion four-year savings target, these figures represent substantial proportions of the entire fiscal envelope. Treasury would require compelling evidence of market failure to justify such expenditure. The current signals: high utilisation, expanding supply and provider expansion provide the opposite story.

This analysis suggests that substantial SIL price increases face significant headwinds, not because provider concerns aren’t legitimate, but because the objective market signals don’t indicate the systemic failure that would justify major expenditure increases in a fiscally constrained environment.

For providers, this creates strategic imperatives:

The 60% of organisations now focusing on market research, strategy and planning (up from 28% in 2024) suggests the sector is already recognising these imperatives.

Understanding the signals policymakers likely observe: high utilisation, expanding supply, provider investment, helps clarify why price increases may not materialise despite legitimate provider advocacy. This doesn’t invalidate sector concerns about challenging operating environments. But it does suggest that solutions may lie more in business model adaptation, consolidation for scale, and operational efficiency than in waiting for pricing relief that the market signals suggest is unlikely.

The disability sector has demonstrated remarkable resilience and adaptability throughout the NDIS journey. The next phase may require applying that same resilience to operating within the current pricing environment rather than expecting it to change.

This analysis draws on publicly available data from the National Disability Services State of the Disability Sector Reports (2023-2025), financial statements from major providers, and market utilisation data. It represents an economic analysis of policy incentives and market signals, not an endorsement of any particular policy position.

Join an exclusive community of providers receiving our eNewsletter Empathia Insider. Get first access to NDIS business insights, free provider resources, and special offers direct to your inbox.

Empathia Group is a collective of business consultants focused on creating sustainable, long-term success for NDIS service providers.

Appointments outside of standard business hours available by request

Empathia Group Pty Ltd © 2022. All rights reserved.

How are you?

If you’re looking for a sandbox experience with endless meme potential, nextbots sandbox of memes is a must-play! Its creative freedom and varied features allow for truly unique and hilarious gameplay scenarios. Jump in and start building your own meme-fueled chaos!

A really good blog and me back again.