Know Why Houses Underperform. Fix It With Confidence.

Connect your roster, funding, and cost data to see exactly why houses underperform and what to do about it. Make evidence-based decisions that improve margins whilst protecting service quality.

Quick Navigation

Integrated Intelligence for SIL Operations

Most SIL providers face the same challenge: their P&L shows a house is underperforming, but doesn't explain why or what to do about it. Is it overstaffing? Poor ratio matching? Inadequate funding? Operational execution problems?

How It Works

Calculate Required Staffing

Our tool analyses your RoC to determine the minimum compliant staffing needed to meet each participant's funded support requirements.

Compare Actual vs Required

Our tool reconciles your payroll data with the RoC to identify exactly where you're overservicing, where ratios are inefficient, and where funding gaps exist.

Optimise the RoC

Our tool helps you restructure Rosters of Care to maximise revenue efficiency whilst maintaining SCHADS compliance and service quality.

Make It Sustainable

Every change is validated for operational feasibility, staff capacity, and participant outcomes before implementation.

Why Your P&L Can't Tell You This

Your P&L shows one number: "House X made 3% margin instead of 6%." But it doesn't separate:

- • Revenue losses from underfunded support requirements

- • Structural wage costs (penalty rates, overtime) from roster design

- • Controllable overservicing from inefficient ratios

- • Overhead allocation inefficiencies

We disaggregate the performance drivers. Business leaders get granular house-level data with a single click, showing exactly which levers to pull.

Expected Outcomes: What Providers Typically Achieve

Based on implementation across 20 houses managing 62 participants

Average house margin increase through structural RoC review, overservicing elimination, and overhead allocation optimisation

Decrease in time spent on RoC management, financial analysis, and manual error correction

Complete visibility into whether committed support hours are actually being delivered to participants

Average number of actionable margin recovery opportunities identified per house in portfolio analysis

What P&L Alone Cannot Tell You

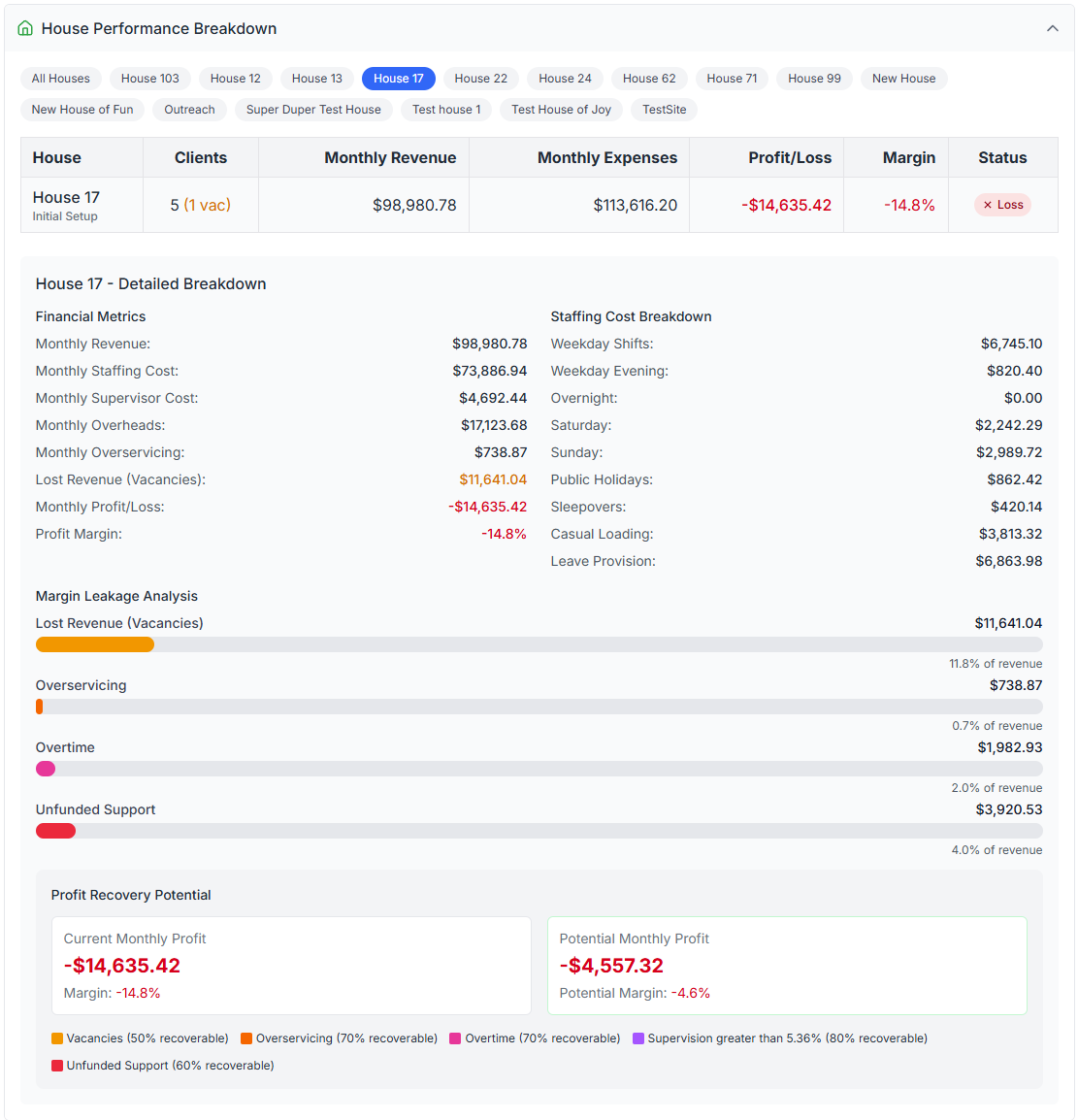

A real scenario showing the difference between traditional analysis and platform-enabled insights

Managing by P&L Alone

House Performance (Monthly)

Management Response:

"Wages are 73% of revenue. We need to cut staffing hours"

But which hours? Are we overservicing agreed Rosters of Care? Is our revenue recognition incorrect? Is there an unaccounted vacancy driving the margin down? The P&L can't tell us, so decisions become guesswork.

Risk:

- May cut staffing participants are actually paying for

- Impossible to know which hours to reduce

- Service quality compromise and compliance breach

- Arbitrary decisions without understanding root causes

- Participants lose supports they've funded

Managing with Integrated Intelligence

House Performance (Monthly)

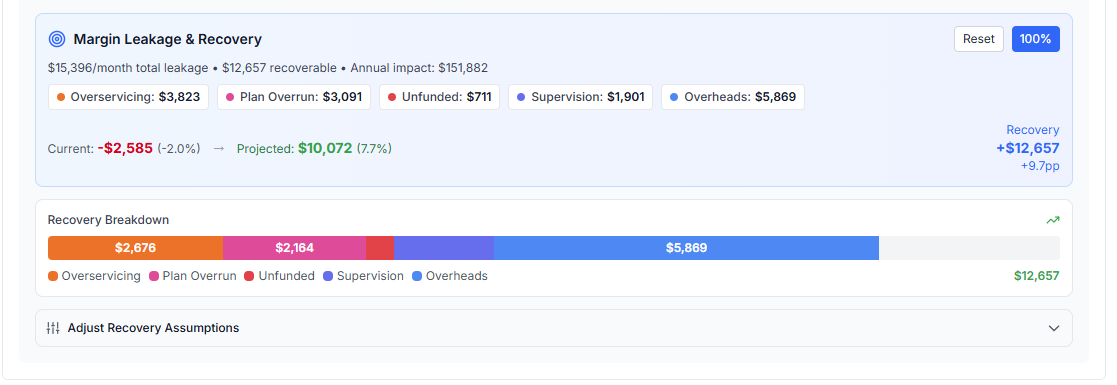

Platform Diagnosis: Margin Leakage & Recovery

Payroll reconciliation showed 5 hours delta from RoC on Sunday

RoC requires 6 additional hours beyond participant funding

Support hours not covered by any NDIS plan (ratio shortfall)

Supervision costs above 5.36% of revenue (supervisor over-allocation)

Overheads above 10.5% target (overhead misallocation)

Evidence-Based Action:

Overservicing ($3,823): Payroll reconciliation showed a 5 hours delta from the RoC on Sunday.

Plan Overrun ($3,091): RoC requires 6 additional hours beyond participant funding. Requires revision or discussion with participant and support network.

Structural Issues ($8,481): Unfunded ratios (ratio shortfall), overhead misallocation, and supervisor over-allocation.

Outcome:

- $15,396 monthly recovery identified ($184,751 annually)

- Zero participant impact. Recovered leakage is unfunded costs

- Evidence-based discussions with participant and network

- Wage-to-revenue improves to 61.1% without cutting funded hours

"We identified $847K in annual overservicing across our portfolio without compromising a single participant outcome. The platform showed us exactly where our RoCs, rosters and allocations were misaligned. SIL requires granular attention to the smallest detail, which can be challenging at scale. These tools automate it."

CEO, Large Not for Profit

Two Products, One Integrated System

Dashboard shows you what's happening. Optimiser helps you improve it. Integration creates confidence.

Dashboard

Performance Intelligence

Purpose: Reconcile payroll to RoC, identifying daily variances between what was rostered and what was delivered.

Key Capabilities:

- Ingests RoC and payroll data for automated reconciliation

- Normalisation steps to align data sources

- Determines required supports vs actual delivery

- Individual daily variance analysis

- Identifies overservicing, underservicing, and structural RoC issues

Optimiser

Portfolio-Wide Roster Planning & Analysis

Purpose: Build evidence-based rosters that optimise funding utilisation whilst maintaining quality, with complete portfolio visibility and audit trail.

Key Capabilities:

- Whole portfolio view with integrated analysis components

- RoC creation, RoC solver and review automation

- Real-time funding impact visibility for every roster change

- Scenario modelling ("what if we change this ratio?")

- Version control, approval workflows, and ownership allocation

Platform Feature Tour

Quick walkthrough of Dashboard and Optimiser working together

Dashboard: See Exactly What's Happening

Stop guessing why houses underperform. Dashboard connects your RoC, funding, and cost data to show you the complete picture.

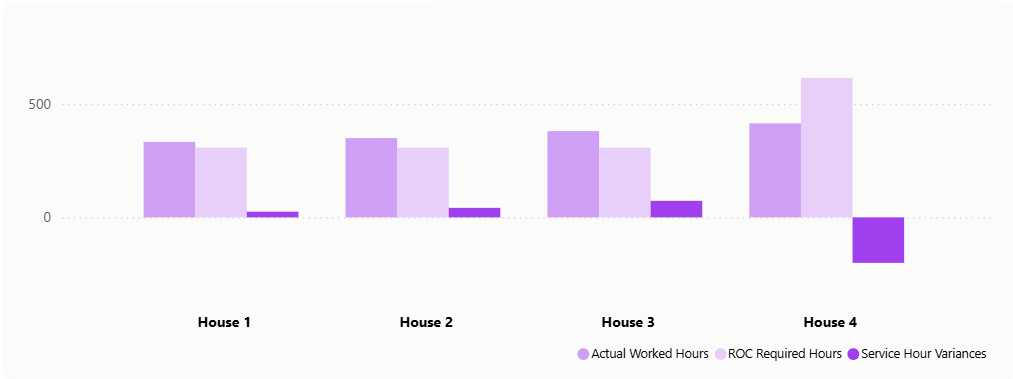

Portfolio overview showing all houses at a glance

Four Essential Reconciliation Insights

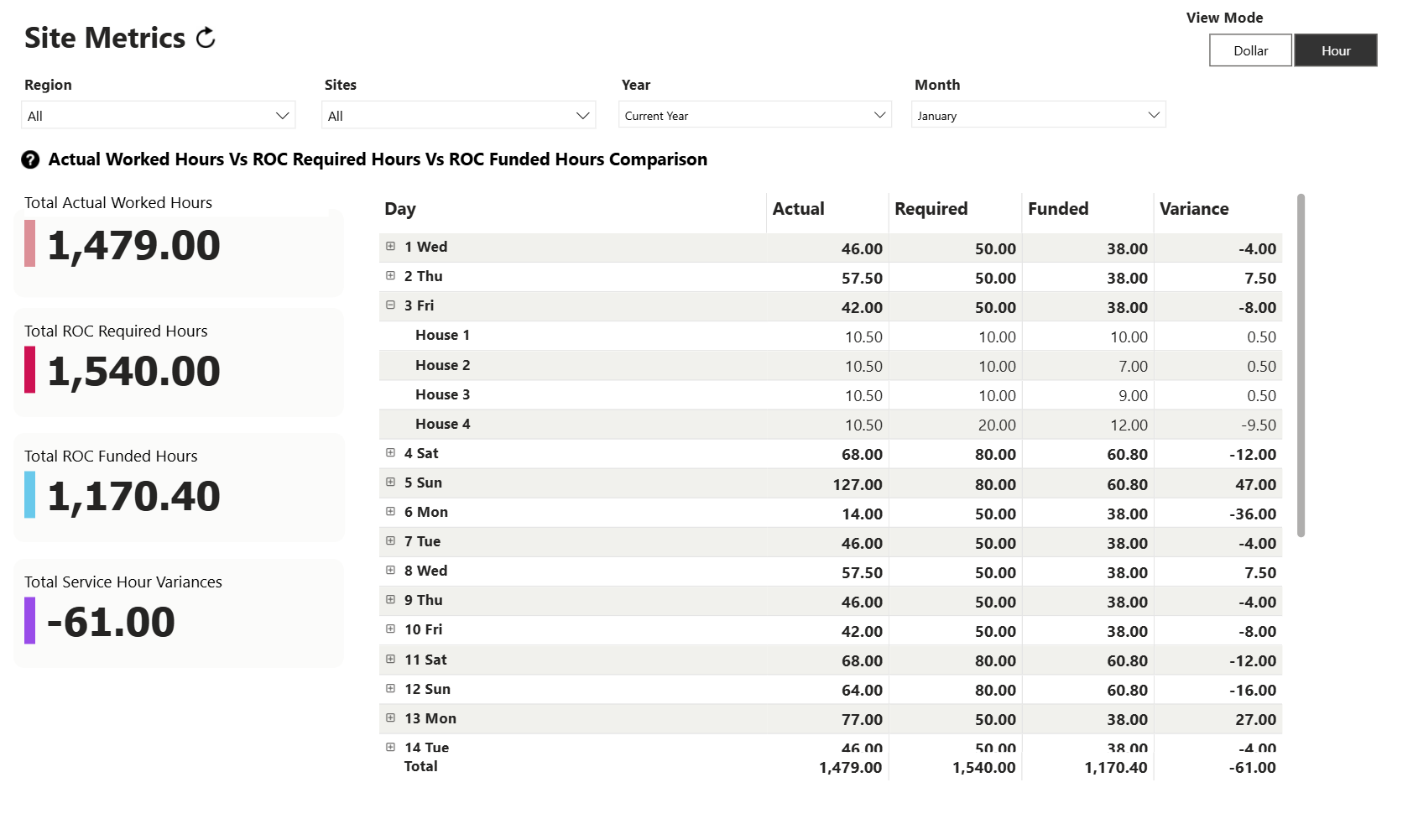

Daily Delivery Variance Analysis

Track exactly when actual staffing deviates from your RoC commitments

- Rostered vs Delivered: Compare what was planned in the RoC against actual payroll records for each day

- Overdelivery Detection: Identify where staff worked beyond rostered hours (unplanned overtime, extended shifts)

- Underdelivery Detection: Spot when rostered support wasn't delivered (call-outs, no-shows, early finishes)

- Shift-Level Granularity: See exact variances by shift, day, and staff member

Why This Matters: Overdelivery costs money you didn't budget for. Underdelivery risks non-compliance with RoC commitments and participant outcomes.

Ratio Compliance Verification

Confirm that delivered support ratios match RoC specifications

- Actual Ratios Delivered: Calculate real participant-to-staff ratios from payroll data

- RoC Ratio Commitments: Compare against documented minimum ratio requirements

- Breach Identification: Flag instances where delivered ratios fell below RoC commitments

- Pattern Recognition: Identify recurring compliance issues across houses or shifts

Why This Matters: Ratio breaches expose you to NDIS Commission scrutiny and compromise participant safety. Early detection prevents systemic issues.

Normalised Minimum Roster Baseline

Intelligent baseline that accounts for real-world constraints and funding realities

- Ratio Misalignment Adjustment: Normalises RoC for unfunded ratio requirements (where documented ratios exceed what funding supports)

- Vacancy Impact Adjustment: Accounts for empty beds and adjusts expected staffing accordingly

- Minimum Required Roster: Builds the true baseline of what should have been delivered given funding and occupancy

- Sufficiency Assessment: Determines whether actual staffing met, exceeded, or fell short of this normalised baseline

Why This Matters: Raw RoC-to-payroll comparison is meaningless if the RoC was undeliverable. Normalisation shows whether variances are legitimate operational issues or structural roster problems.

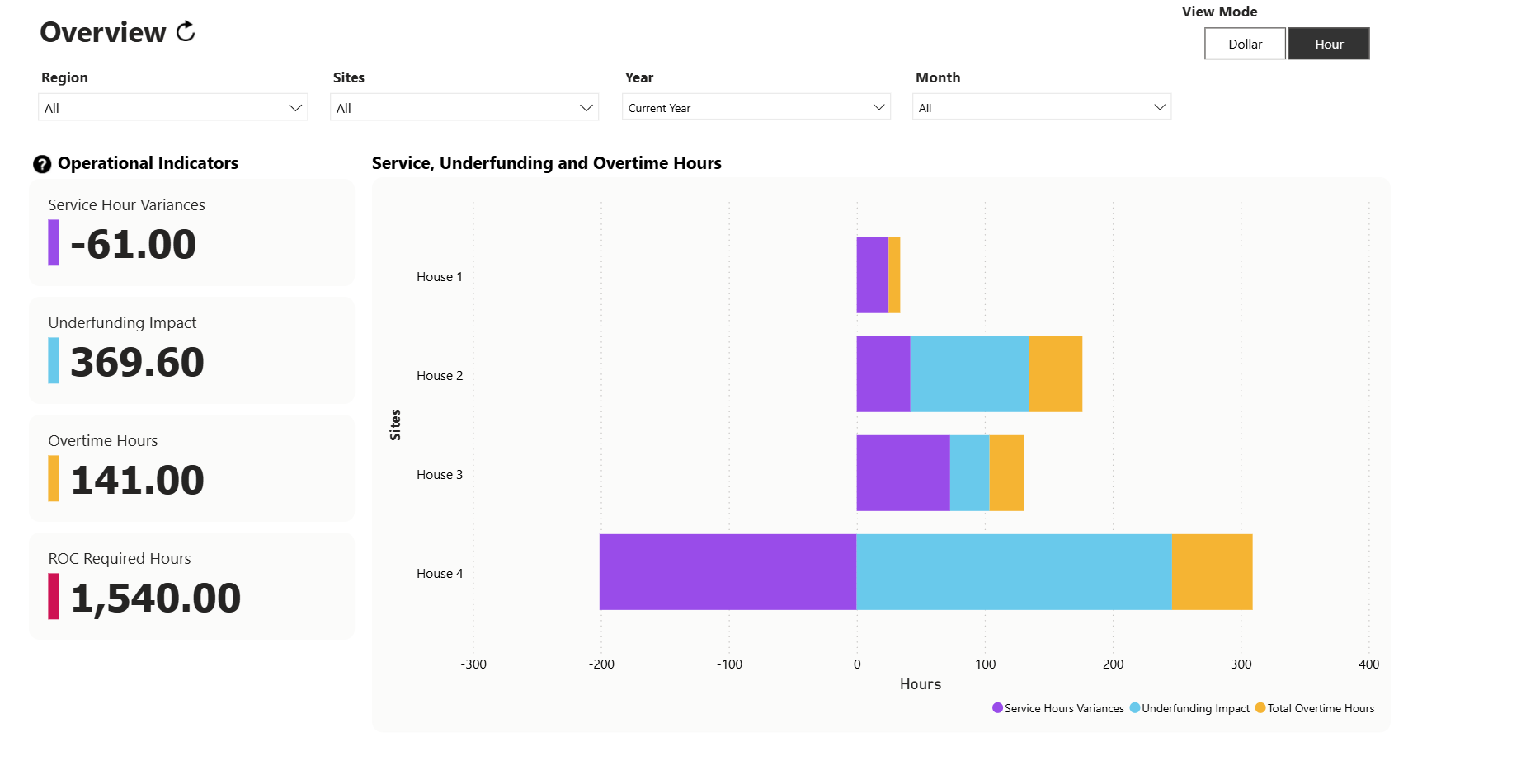

Systematic Overdelivery Detection

Identify houses where delivery consistently exceeds what the RoC allows for

- Persistent Variance Patterns: Distinguish one-off operational issues from structural overdelivery habits

- House-Level Benchmarking: Compare variance patterns across portfolio to identify systematic offenders

- Cost Impact Quantification: Calculate cumulative financial impact of recurring overdelivery

- Root Cause Indicators: Surface whether systematic overdelivery stems from roster inadequacy, operational execution, or poor ratio discipline

Why This Matters: If a house consistently delivers more than rostered, either the RoC is wrong or operational discipline is lacking. This shows exactly where intervention is needed.

Key Dashboard Features

Easy Data Upload

Effortless tools to grab your key data. Battle-tested normalisation steps to convert RoCs into essential data sources.

Inbuilt Business Logic

Automatically determines minimum rosters and funding gaps. Built-in understanding of SCHADS requirements and SIL funding models.

Variance Detection

Automatically determines variances between funded, minimum, and actual rosters to detect under and overservicing on a per-day basis.

Drill-Down Analysis

Visualise and drill down into key data. Shows where to focus improvement efforts.

Export Capabilities

Export detailed reports and analysis for board presentations, audits, or deeper investigation.

Real-Time Updates

As roster data changes, dashboard automatically recalculates all metrics and flags new issues.

Portfolio overview showing all houses at a glance

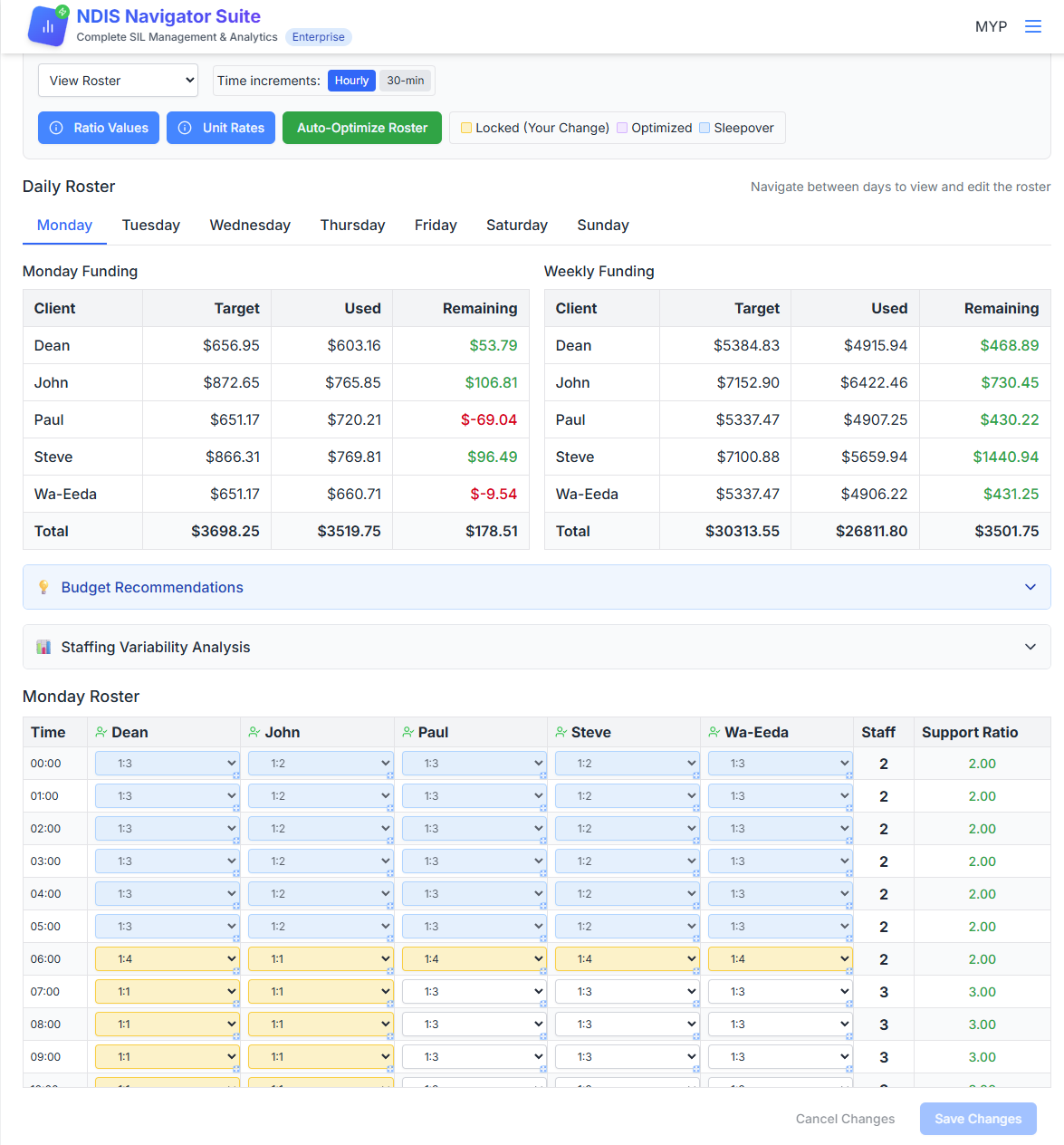

Optimiser: Make Evidence-Based Roster Decisions

Dashboard shows the problem. Optimiser lets you fix it. Integration ensures every decision is evidence-based, compliant, and fully documented.

Full roster planning view with real-time funding impact analysis

How the Optimiser Works

Set Participants

Enter participant details: funding level, needs assessment, funded hours

Build Roster

Define support ratios for each timeslot based on participant needs and activities

Review Impact

See real-time funding consumption, SCHADS compliance, and cost projections

Save & Audit

Version control captures every change with timestamp, user, and approval status

Key Optimiser Capabilities

Automated RoC Creation & Solver

Build rosters from scratch or optimise existing ones with intelligent automation

- Quick Setup: Input participant funding, needs, and occupancy patterns to generate initial rosters

- Ratio Optimisation: Solver automatically adjusts ratios to maximise funding efficiency whilst meeting requirements

- Portfolio Repository: Centralised storage for all RoCs with easy access and version management

- Key Metric Surfacing: Instantly see funding burn rate, margin impact, and unfunded support for every roster configuration

Why This Matters: Stop building rosters in Excel with manual calculations. Automation ensures accuracy and surfaces optimisation opportunities you'd miss manually.

Comprehensive Financial Analysis Suite

Model the exact financial impact of any roster change before implementation

- Real-Time Impact Modelling: See margin, revenue, and cost changes instantly as you adjust ratios

- Cost Driver Breakdown: Understand base staffing costs, penalty rates, overheads, and unfunded support

- Scenario Comparison: Create multiple "what if" scenarios and compare financial outcomes side-by-side

- Participant-Level Detail: Track each participant's funding consumption, funded hours vs rostered hours, and annual projections

Why This Matters: Make roster decisions with complete financial transparency. Know exactly how every change affects house profitability before you commit.

Portfolio-Wide Performance Aggregation

Interrogate and optimise all RoCs across your entire portfolio in one place

- Consolidated View: See total portfolio performance, aggregated margins, and overall funding utilisation

- Structural Issue Detection: Identify systematic problems across houses (ratio misalignment, unfunded support patterns)

- Comparative Benchmarking: Compare house performance to identify what excellent execution looks like

- Opportunity Quantification: Calculate total recoverable margin across portfolio from identified inefficiencies

Why This Matters: Stop analysing houses in isolation. Portfolio-wide visibility reveals patterns and opportunities that single-house analysis misses.

Financial Forecasting Tools

Project future performance and model strategic changes across time horizons

- Annual Projections: Forecast full-year outcomes based on current roster configurations

- Participant Change Modelling: Model impact of new admissions, departures, or funding changes on house economics

- Growth Planning: Assess whether new participants are financially viable given current roster structures

- Month-by-Month Variance: Understand how public holidays, weekends, and occupancy patterns affect monthly margins

Why This Matters: Stop making decisions based on current state alone. Forecasting prevents mid-year funding crises and enables confident strategic planning.

Portfolio overview showing all houses at a glance

Why Integration Matters: Dashboard + Optimiser

Standalone tools create data silos. Integration creates intelligence.

The Plan → Monitor → Improve Loop

- Optimiser designs: Build the initial RoC with optimal ratios, funding utilisation, and projected margins

- Dashboard monitors: Reconcile payroll against the RoC, identifying "House 7 consistently delivers 5 extra hours every Thursday/Saturday"

- Optimiser models: Test whether the variance is structural (RoC inadequate) or operational (poor execution), model corrections

- Dashboard confirms: After implementing changes, verify the variance is eliminated and margin improves by $42K annually

The Confidence Multiplier

- Evidence-Based Decisions: Every RoC change backed by Dashboard data showing exact financial impact of delivery patterns

- Complete Financial Visibility: Optimiser models the plan, Dashboard validates actual performance, together they show true house economics

- Stakeholder Communication: Show Plan Managers precise data on funding shortfalls vs operational inefficiencies with evidence from both systems

- Continuous Improvement: Systematic feedback loop between planning and delivery creates ongoing margin optimisation

Bottom Line: Plan Smart, Monitor Reality, Optimise Continuously

Optimiser ensures your RoCs are financially viable. Dashboard shows whether they're being delivered as planned. Integration creates the feedback loop that drives continuous margin improvement.

Value for Every Key Stakeholder

Different roles need different outcomes. Here's what each stakeholder gets.

For CEOs: Strategic Control Without Operational Overload

Your Challenge:

You need to improve financial performance whilst protecting service quality—but lack visibility into where improvement opportunities actually exist. Board asks for margin improvement, but current reporting can't tell you whether that's achievable without compromising participants.

What You Get:

- Strategic Dashboard: Portfolio-wide visibility into performance by house, enabling data-driven resource allocation decisions

- Board-Ready Reporting: Demonstrate to Board exactly what's driving underperformance and what actions are being taken

- Risk Visibility: Early warning system for delivery issues and funding overruns before they become crises

- Growth Enablement: Identify which houses can absorb new participants vs. which need restructure first

Expected CEO Outcomes:

- Confidence: Make strategic decisions backed by evidence, not intuition

- Performance: Portfolio margin improvement of 2-5% without quality compromise

- Governance: Evidence-based decision trail demonstrating due diligence in roster and funding management

- Time: Stop firefighting—focus on strategy instead of operational crises

Bottom Line: Run your organisation with confidence that financial decisions are protecting (not compromising) participant outcomes.

For CFOs: Precision Financial Management Beyond P&L

Your Challenge:

P&L shows houses underperforming but doesn't tell you why or what to do about it. You know costs are high but can't differentiate between legitimate funding shortfalls, operational inefficiency, and penalty rate impacts—so you can't give operations actionable guidance.

What You Get:

- Root Cause Clarity: Every underperforming house explained: base cost, penalty rates, overservicing, vacancy impact

- Forecasting Accuracy: Understand funding utilisation trajectory to predict cash flow and margin with confidence

- Business Case Support: Evidence-based data for Plan Manager negotiations when funding is genuinely insufficient

- Portfolio Benchmarking: Compare house performance to identify operational excellence vs. structural funding problems

Expected Financial Outcomes:

- Accuracy: House-level P&L that actually explains performance drivers

- Control: Identify and eliminate 10-15% overservicing cost across portfolio

- Predictability: Funding utilisation tracking that prevents mid-year service reduction crises

- Efficiency: Reduce month-end financial analysis time by 55% through automated reconciliation and reporting

Bottom Line: Move from "we're underperforming" to "here's exactly why and what to do about it."

For COOs: Operational Excellence Without Compromising Service Quality

Your Challenge:

You're responsible for both operational efficiency AND service quality—two objectives that appear to conflict when margins tighten. When finance pressures you to reduce costs, you lack tools to identify where efficiencies exist without compromising participant outcomes.

What You Get:

- Service Quality Protection: Before any roster reduction, understand exactly how the change affects each participant's funded support hours

- Performance Diagnostics: When a house underperforms, see whether it's roster inefficiency, poor ratio matching, funding shortfall, or operational execution

- Portfolio Benchmarking: Compare house performance to identify what excellent execution looks like—then replicate it

- Evidence-Based Decisions: Replace intuition with data showing where genuine efficiencies exist versus where cuts harm quality

Expected Operational Outcomes:

- Quality: Make roster decisions with confidence that service quality is protected

- Efficiency: Identify 10-15% cost reduction opportunities in overserviced houses without participant impact

- Delivery Assurance: Verify rostered support is actually being delivered, eliminating underservicing risk and participant outcome concerns

- Capability: Build operational excellence systematically across portfolio through benchmarking

Bottom Line: Make confident operational decisions backed by data that proves you're improving efficiency whilst protecting (or improving) participant outcomes.

From First Call to Full Value in 90 Days

Phased implementation that delivers immediate value whilst building towards comprehensive capability

RoC Repository Setup

- Immediate integrity audit risk mitigation

- Import existing roster data

- Train staff on version control

- Establish approval workflows

Value Delivered: Audit trail confidence from day one

Financial Analysis Integration

- Connect funding and cost data

- House-level performance diagnostics

- Identify improvement opportunities

- Dashboard training for key staff

Value Delivered: Understand exactly where performance gaps exist

Roster Optimisation

- Implement evidence-based improvements

- Track margin impact in Dashboard

- Refine based on results

- Build house manager capability

Value Delivered: Measurable margin improvement without quality compromise

Portfolio Analytics & Strategic Reporting

- Consolidated business intelligence

- Board-level reporting established

- Strategic decision support capability

- Continuous improvement processes embedded

Value Delivered: Complete operations intelligence system operational

What You Need to Get Started

Minimal technical requirements—we handle the heavy lifting

RoC Documents

Current rosters in any format (PDF, Excel, Word)

Funding Data

Participant funding levels and annual allocations

Cost Data

Labour costs and overhead rates (we help if unavailable)

See What We'd Find in Your Portfolio

Book a 30-minute discovery call. We'll analyse one of your houses and show you exactly what the platform would reveal about your operations.

No pitch deck. Just data-driven insights about your actual performance.

✓ Your Data Remains Yours

We never share provider information or use it beyond your specific analysis

✓ No Lock-In

Month-to-month agreements. If we're not delivering value, you can leave anytime

✓ Australian Support

Local team who understand SIL operations. Not a generic help desk