Recent Federal Court Rulings on NDIS Payment Reviews

January 16, 2025

Recent Federal Court Rulings on NDIS Payment Reviews

Two recent Federal Court decisions have shed new light on how the National Disability Insurance Agency (NDIA) handles payment reviews for NDIS service providers. While no doubt many of you have heard of “periodic payment reviews”, these cases provide some crucial insight into how they function. If you operate in this space—especially on thin margins—understanding these rulings may be critical to protecting your organisation’s cashflow and ensuring regulatory compliance.

- Northern Disability Services Pty Ltd v National Disability Insurance Agency (9 August 2024)

- Affinity Care Services Pty Ltd v National Disability Insurance Agency (19 November 2024)

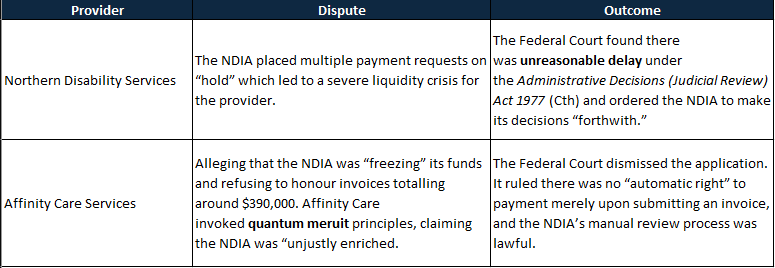

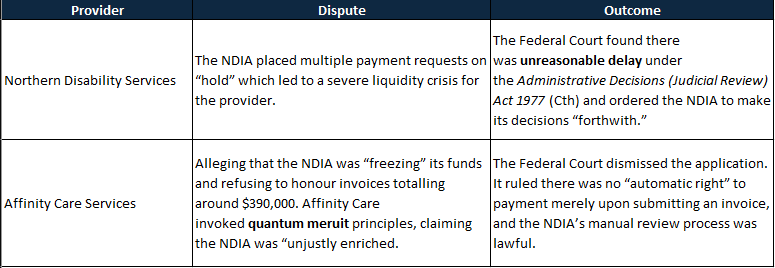

Figure 1: Case Summary.

The first case highlights what effectively amounts to indefinite “holds” on provider payments, whereas the second clarifies why unregistered providers have no automatic right to be paid on a quantum meruit (unjust enrichment) basis. Below is a rundown of both, including some practical takeaways—and insights into the NDIA’s underlying “payment review” process, how it can affect even large providers, and how technology solutions can help you remain compliant.

What was noted in both cases was an entitlement to review claims. So, it appears that neither case portends the end of periodic payment reviews, which means that providers understanding the process. Finally, it is worth pointing out at the start the NDIA appears to have caught significant fraud in the process.

Northern Disability Services Pty Ltd v NDIA

Snapshot

- Provider: Northern Disability Services (a registered NDIS provider).

- Dispute: The NDIA placed multiple payment requests on “hold” which led to a severe liquidity crisis for the provider.

- Outcome: The Federal Court found there was unreasonable delay under the Administrative Decisions (Judicial Review) Act 1977 (Cth) and ordered the NDIA to make its decisions “forthwith.”

Overview

Northern Disability Services alleged that, after the NDIA flagged certain invoices for manual review, it effectively ceased payment. Over a million dollars’ worth of claims remained in limbo. Because cashflow is paramount for most NDIS providers—who must continue paying staff and sub-contractors—the provider came perilously close to insolvency.

The Court noted that section 45 of the National Disability Insurance Scheme Act 2013 (Cth) (NDIS Act) mandates the NDIA to decide whether an amount is “payable” in respect of a participant’s plan. Even though the NDIA is entitled to verify invoices for potential non-compliance, it cannot simply place claims on indefinite hold.

Highlights

- Decision Under an Enactment

- The NDIA argued it was merely “checking” claims, not making any formal “decision.” The Court rejected this, ruling that checking claims under s45 is indeed an administrative decision subject to judicial review.

- Unreasonable Delay

- There is an implied duty to act within a “reasonable time.” The Court found the NDIA took too long (several weeks, in some instances months) before providing an outcome or a rejection.

- Immediate Relief

- The Court ordered the NDIA to finalise its reviews “forthwith” and to file evidence confirming compliance.

We’ll get into the general mechanics of payment reviews later, but in principle, this case highlighted that the NDIS is entitled to manually review claims. In terms of the documents requested, it may be increasingly important to have them on hand.

Practical Takeaways

- Document Rigor: Providers must be able to swiftly produce timesheets, service logs, and participant agreements. Any missing information may result in continued (and reasonable) delays.

- Legal Recourse: If your cashflow is threatened by indefinite NDIA reviews, Northern Disability Services suggests the Courts may intervene if “unreasonable delay” is evident. However, it did not address the claim process itself, which means preparedness is crucial.

- Cooperative Approach: Where possible, address any NDIA information requests quickly. Partial or late submissions risk prolonging reviews further.

Affinity Care Services Pty Ltd v NDIA

Case Snapshot

- Provider: Affinity Care Services (an unregistered provider).

- Dispute: Alleging that the NDIA was “freezing” its funds and refusing to honour invoices totalling around $390,000. Affinity Care invoked quantum meruit principles, claiming the NDIA was “unjustly enriched.”

- Outcome: The Federal Court dismissed the application. It ruled there was no “automatic right” to payment merely upon submitting an invoice, and the NDIA’s manual review process was lawful.

Key Facts

Affinity Care was flagged for potential improper billing. The NDIA placed claims under manual review—meaning no automated payments. The provider argued it was effectively insolvent by November 2024 without those funds. The applicant also said that by posting “Requests for Services” on the NDIA’s portal, the NDIA itself was “requesting” the services—hence a direct quantum meruit obligation.

Highlights

- No Automatic “Right to Payment”

- The Court reiterated that s 45 merely sets out how the NDIA determines “amounts payable” under a participant’s plan. It does not confer an immediate entitlement to providers without NDIA approval.

- Quantum Meruit Rejected

- To succeed, a quantum meruit claim requires the defendant to receive a tangible benefit at the claimant’s expense. Since NDIS participants—not the NDIA—benefit from the services, the Court ruled the NDIA is not “unjustly enriched.”

- Manual Review Powers

- Requests for documentation (RTP letters) are within the NDIA’s broad statutory mandate. The NDIA can seek timesheets, staff details, logs, etc., before approving any payment.

- Unregistered Status

- Although an unregistered provider can still claim NDIS funds via plan-managed or self-managed participants, the NDIA is entitled to verify compliance thoroughly, particularly if there have been concerns or tip-offs about the provider’s claims.

Practical Takeaways

- Cashflow Planning: If you rely heavily on rapid processing of invoices, an NDIA hold can be devastating. Providers, especially unregistered, may do well to consider contingency funds or lines of credit to weather temporary payment suspensions.

- Transparency: Keep meticulous records of every shift, travel log, or support hour delivered. The NDIA’s request for evidence is valid, and responding in full appears to be the fastest way to unlock payments.

- No Shortcut via Unjust Enrichment: Where the NDIA defers payment for additional checks, you cannot bypass that process by claiming the NDIA “owes” you. The NDIA’s function is to protect the scheme’s integrity and can hold or refuse claims until satisfied they align with a participant’s plan.

A Note on Publicly Listed Providers: Freedom Care Group Holdings (ASX: FCG)

Recent disclosures on the ASX indicate that Freedom Care Group Holdings Ltd (ASX: FCG) has also been subject to NDIA payment suspensions. Initially, they did not consider these suspensions price sensitive. However, after legal advice and board discussions, they announced that ongoing audits and the potential for NDIA registration revocation had become material to their stock value. Reports suggest Freedom Care Group’s NDIS revenues exceed $20 million, illustrating that:

- Even large or listed providers can experience payment reviews or suspensions.

- Such compliance challenges can rapidly affect investor confidence, as shown by trading halts or announcements flagging solvency risks.

- A NDIA suspension, if extended, can pose serious operational impacts—and becomes material information for shareholders and the broader market.

Although the specific facts for FCG are not fully known, the takeaway is that no provider—regardless of size—can ignore the ramifications of a NDIA audit or payment “hold.” The potential ramifications for solvency, investor relations, and operational continuity must be carefully managed.

Understanding the NDIA’s Payment Review Process

Both the Federal Court rulings and the FCG development underscore the standard “payment review” protocol when the NDIA suspects—or wants to verify—claim integrity:

- Temporary Suspension of Payments

- The NDIA flags certain invoices for manual review (often due to a tip-off or internal risk indicators). Automated processing ceases: no funds are released while investigations proceed.

- Request for Information (RTP)

- The Agency sends providers a letter identifying specific participants, invoices, or date ranges under scrutiny. Typically, it demands timesheets, service logs, worker credentials, and any case notes relevant to the claims.

- Provider Response

- Providers must compile extensive documentation, often with short deadlines.

- Failure to supply sufficient details promptly can result in extended holds or outright claim rejection.

- Manual Review & Verification

- NDIA officers assess the submitted material for consistency with the participant’s plan, reasonableness of hours, staff ratios, and any signs of over-servicing or mis-billing.

- They may also contact participants or plan managers directly to confirm supports provided.

- Determination to Release or Reject

- If claims are verified, payment is processed (often retroactively).

- If irregularities persist, the NDIA may reject the claim entirely or request further clarification.

This multi-step process can, if poorly managed, stall a provider’s entire revenue stream for weeks or months. Moreover, as seen in the Freedom Care Group situation, it can become a material event for publicly listed entities—threatening not just daily operations but also share price stability.

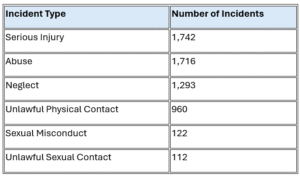

These cases outline the essential steps in the periodic payment review process and provide some weight to the legitimacy of the NDIA’s effort. While no doubt extremely disruptive in a market with notoriously thin margins, the NDIA is entitled to conduct reviews where it sees fit. In talking with providers affected by payment freezes, we have noticed that the NDIA does address multiple potential fraud vectors, including verifying if the associated labour with a claim has been performed and that the participant indeed requested the service. Avid readers may recall that Empathia suggested years ago that the reconciliation of labour and claims is the most effective way to detect and uproot fraud. It appears the NDIA have developed the teams, skill and means to do this at substantial scale.

Naturally, a provider’s best response is to simply ensure their house is in order, and that they can their CMS can produce roster, timesheet, claiming and service agreement data promptly and in a organised manner. It also means that providers should have a detailed understanding of how their labour and claims align. This is not to just ensure compliance, but also to ensure the ongoing viability of their business.

How Our Dashboard Solution Can Help

At Empathia Group, we’ve developed an integrated dashboard specifically tailored for NDIS providers—registered or unregistered.

- Smart Data Ingestion & Normalisation

Our platform automatically imports your daily “Record of Care” (RoC) data, timesheets, and scheduling logs, then normalises that information so labour and claim data are aligned. - Real-Time Alerts on Under- or Over-Servicing

The system continuously analyzes shifts, staff rosters, participant requirements, and daily vacancy data—pinpointing where you might be delivering more supports than a participant’s plan typically permits, or conversely, too few.

- Automated Compliance Checks

Our solution cross-references each support session against the participant’s plan attributes (e.g., support ratios, hours per day, budget categories). If a service time is questionable, the system suggests corrective action or flags it for manual verification. This drastically reduces surprises if the NDIA demands logs later. - Comprehensive Dashboard Views

Managers can visualize each day’s service usage, plan budgets, staffing capacity, and any “off-norm” patterns that might trigger require further review. By seeing real-time data in one place, you can self-audit regularly to ensure that all claims align with plan parameters. - Security & Scalability

Built to handle large volumes of participant data securely, our platform ensures you remain fully prepared.

Fundamentally, our solution is about giving providers a complete, normalised and daily view of exactly what labour they were paid (and expected ) to provide, and what was actually supplied on shift. In the course of our work across 100s of providers, we’ve learned that a precise understanding of labour allocation is often the core determinant of compliance and viability.

Final Observations

- Expect Scrutiny if Concerns Arise

- Both rulings confirm that while the NDIA may process most claims automatically, any suspicion can trigger manual review. That review can significantly delay payments—even if your NDIS revenue is tens of millions of dollars.

- Legal Remedies Are Limited

- A provider’s best strategy is robust documentation and an early, comprehensive response to NDIA queries. Court proceedings are expensive, time-consuming, and not guaranteed to yield swift financial relief.

- Thin Margins Demand Vigilance

- Many NDIS providers (even large, publicly listed ones) depend on quick invoice turnover. Delayed payments can threaten business continuity or stock value. Pre-emptive compliance steps are essential. It should be understood that an implied 2% margin doesn’t contribute particularly strongly to a healthy balance sheet.

- Digital Solutions for a Safer Cushion

- By leveraging a platform that ingests, normalises, and monitors your daily care records, you’ll detect over-servicing (or under-servicing) issues early.

Key Lessons for NDIS Providers

- Maintain Full Records: Timesheets, daily logs, support worker verifications—these should be updated continuously. Delays often stem from documentation gaps.

- Stay Proactive: It may be prudent to test how your organisation would supply information requested in a periodic payment review, and if the data exists presently in a usable format.

- Consider Cashflow Buffers: Don’t assume near-instant payment for every invoice. Budget for potential disruptions, especially if your monthly outgoings heavily rely on NDIA reimbursements.

- Know Your Rights—and Limits: While you can challenge indefinite or unexplained delays, you cannot force payment if the NDIA lawfully seeks to confirm service validity.

- Embrace Technology: Tools like our Empathia Group Dashboard can highlight compliance risks early, automatically compile evidence for the NDIA, and keep service delivery aligned with participant plans.

- Publicly Listed? Extra Caution Needed: As in Freedom Care Group’s situation, NDIA payment reviews can affect not just operations but also investor confidence.

Recent Federal Court rulings and the experience of a publicly listed provider show that NDIA payment reviews can quickly escalate from simple invoice checks to major operational, solvency, and investor-relations challenges. The NDIA must not unduly stall decisions, yet providers—whether small or large—cannot assume they have an absolute right to swift payment.

The best defense? Comprehensive documentation, proactive compliance, and cutting-edge analytics to detect service anomalies early.

Share this article:

Continue reading Empathia Insights

Kafkaesque: The Moral Hazard at the Heart of SIL

Kafkaesque: The Moral Hazard at the Heart of SIL Dean Bowman November 18, 2025 Supported Independent Living The Federal Court's...

토닥이의 여성전용마사지 세심하고 따뜻한 케어는

마치 가족처럼 안심되고 편안해서, 처음부터 끝까지 안정감 있게 받을 수 있었어요.

dubai car rental without deposit https://drivelity.com